CALGARY — There is no feasible scenario where a new oil pipeline from Alberta to the west coast could be filled with “decarbonized barrels” of oilsands bitumen, a new report from the Pembina Institute finds.

This is the case even if a theoretical pipeline were twinned with the Pathways Alliance carbon capture and storage project, via the “Pathways Plus” concept the federal government has signalled it is considering for the next tranche of major projects, to be announced next month.

Instead, the report finds significant emissions reductions could be achieved in the oilsands, not via a “grand bargain” of a fast-tracked pipeline, but through strengthened industrial carbon pricing systems. This, along with the comprehensive federal and provincial subsidies already on offer for carbon capture projects, would create the necessary investment certainty to move the Pathways project (which was first proposed by oilsands companies more than four years ago) to final investment decision.

The Pathways project itself, the report highlights, would involve billions of dollars of private capital pouring into Alberta. It should alone be seen as a major project that would create economic growth, help futureproof the oilsands sector, and contribute to Canada’s climate objectives – but only if it is not twinned with a new pipeline.

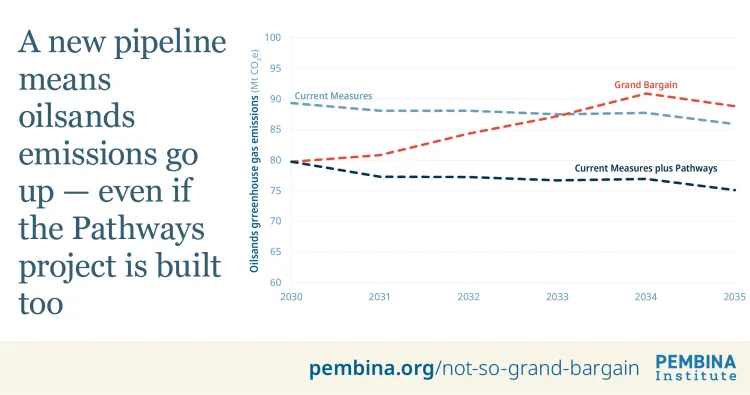

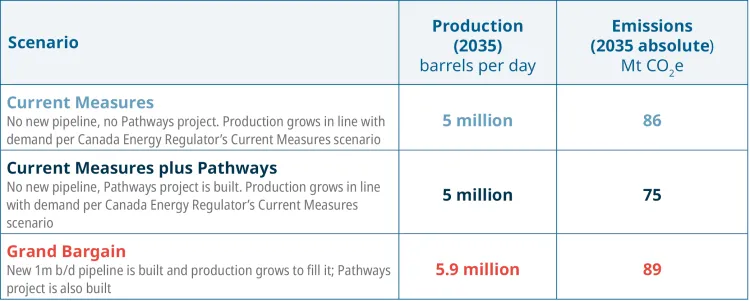

The report examines three potential scenarios: Current Measures, where no additional pipeline and no carbon capture is built; Current Measures plus Pathways, where no pipeline is built but the Pathways carbon capture project is built in full; and finally Grand Bargain, where both a million-barrel-per-day pipeline is built and the Pathways project is realized in full.

Of the three scenarios, by 2035 oilsands emissions are highest in the Grand Bargain; even higher than in a scenario where no new pipeline is built.

By contrast, in a scenario where Pathways is built without a new pipeline, by 2035 oilsands emissions are 14 megatonnes lower than in the Grand Bargain. This is roughly equivalent to the emissions of all iron and steel production in Canada today – underscoring the huge decarbonization opportunity that would be missed if carbon capture is twinned with a new pipeline.

Crucially, in this Current Measures plus Pathways scenario, oilsands production still steadily increases over the next five years in line with global oil demand forecasts, reaching over 5 million barrels per day by 2035. This is an amount that could be exported via an expansion of the Trans Mountain Pipeline, the report argues, with no need for new infrastructure.

Most importantly, incentivising the oilsands companies to build carbon capture via a durable policy such as industrial carbon pricing would help ensure companies invest in further emissions reductions in the years ahead. This matters, given even in the report’s most favourable emissions scenario, by 2035 the oilsands would likely remain one of Canada’s highest-emitting sectors.

Quotes

“It’s important to remember that the Pathways project – as monumental as it would be if built – certainly would not balance out the emissions that a new million-barrel-per-day pipeline would create. As Alberta and Ottawa continue their negotiations, they should be clear-eyed about how climate competitive the so-called “Pathways Plus” project could possibly be, given it would result in even higher oilsands emissions than we already have.

“Instead of grand bargains between the governments of the day, we need long-lasting, durable policies that will finally work to incentivise deep emissions reductions from the oilsands. This in turn will allow policymakers and businesses to focus instead on growing industries that will deliver long-lasting economic prosperity that is aligned with a liveable climate.”

— Janetta McKenzie, Director, Oil and Gas, Pembina Institute

Quick facts

- As of 2024, oilsands production was 4.7 million barrels per day of mined, in situ, and upgraded bitumen, with emissions at 92 megatonnes of carbon dioxide equivalent (Mt CO2e) annually.

- In all scenarios, we assume that emissions intensity trends from 2019-2023 continue, meaning emissions intensity declines on average 1% per year over the forecast period. This is why, in our Current Measures scenario below, emissions fall to 2035 despite production increasing.

- We believe this to be an optimistic assumption with regards to emissions intensity given that firms have likely exhausted cheaper abatement technologies, and recent moves by the Government of Alberta have further weakened the TIER market.

- Emissions reductions resulting from carbon capture (in the second two scenarios) are considered to be in addition to projected intensity improvements.

- According to the latest figures, since 2005, oilsands emissions have grown by 151%. This is the opposite trajectory of the rest of Canada, where emissions on average across the economy have fallen by 8.5% during the same period. Oilsands emissions have grown every year since 2005, other than 2020, when production fell significantly during the height of the COVID pandemic.

- The oil and gas industry – which includes the conventional as well as oilsands sector – contributes approximately one-twentieth of Canada’s GDP, but one-third of the country’s emissions.

[30]

Download a copy of A Not-so-Grand Bargain: The quest for “decarbonized barrels” in the oilsands.

Contact

Benjamin Alldritt

Senior Communications Lead

587-328-1955

Background

Blog: Grand bargains and perilous pitfalls

Op-ed: Does pipeline fever mean missed opportunity elsewhere?

Statement: Alberta should heed private sector caution on pipelines

Report: Drilling Down: Oil and gas jobs in transition