Discussion of a “grand bargain” between the Government of Canada and the Government of Alberta has emerged in recent months. We ascertain this is a deal whereby the federal government fast-tracks a new bitumen pipeline through federal environmental assessments, while the Pathways Alliance of oilsands companies builds its carbon capture and storage project. This has been characterized by both governments as a scenario that would result in “decarbonized barrels” of oil from the oilsands, and a “climate competitive” major project for Alberta under the auspices of nation-building.

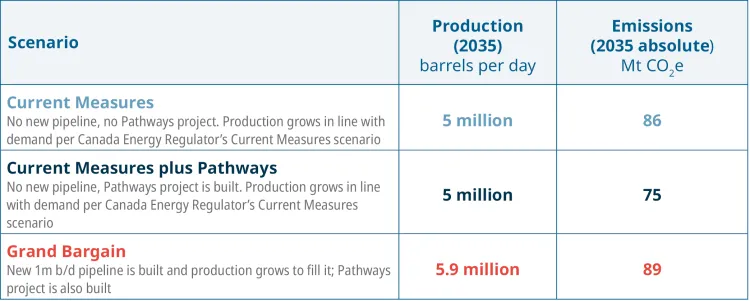

The prospect of a pipeline is still entirely hypothetical, with neither a private sector proponent nor evidence of substantive plans from oilsands companies to markedly increase their production to fill such a pipeline. Nevertheless, given these live discussions it is worthwhile to articulate the potential emissions impacts of such a project. To explore these concepts of “decarbonized barrels” and the “grand bargain” further, this report examines three scenarios:

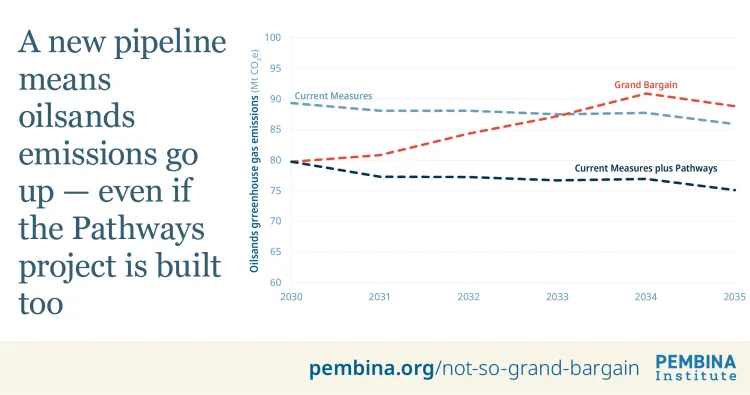

- Current Measures scenario: Using the Canada Energy Regulator’s Current Measures scenario, which foresees growing oilsands production out to 2035, we forecast emissions to 2035 if current emissions trends were to continue.

- Current Measures plus Pathways scenario: We then re-examine how oilsands emissions would evolve if the Pathways carbon capture project were also completed and operational, starting in 2030.

- Grand Bargain scenario: Finally, we model a “grand bargain,” where a one-million-barrel-per-day pipeline is built, major new oilsands developments are built to fill said pipeline, and the Pathways carbon capture project is realized in full.

Of these three scenarios, the Grand Bargain, far from resulting in “decarbonized barrels”, actually results in the highest absolute oilsands emissions — reaching 89 megatonnes (Mt) CO2e annually by 2035. Crucially, however, the Current Measures plus Pathways scenario does result in both increased oilsands production and significant emissions reductions, and therefore appears most congruent with the objectives of both Alberta and the federal government.

Overall, we suggest that the “grand bargain,” in which a theoretical pipeline is offered in return for large-scale carbon capture deployment, is a poor way to achieve a decarbonized oilsands, or even substantial emissions reductions from the sector. Rather, regulation could be used to further de-risk the Pathways project and ensure private investment moves ahead.

On this, we suggest industrial carbon pricing should be strengthened to send an investment signal to the oilsands companies to move forward with Pathways. If done in conjunction with finalized methane regulations (which mainly work to spur investment in decarbonization of the conventional oil and gas sector), this would also render the proposed federal oil and gas emissions cap — to which Alberta has voiced considerable opposition — redundant.

If this can be achieved, Alberta and Canada will have facilitated a major influx of private investment in the oilsands, in a way that can be fairly characterized as “climate competitive”.

Key report findings

- As of 2024, oilsands production was 4.7 million barrels per day of mined, in situ, and upgraded bitumen, with emissions at 92 megatonnes of carbon dioxide equivalent (Mt CO2e) annually.

- In all scenarios, we assume that emissions intensity trends from 2019–2023 continue, meaning emissions intensity declines on average 1% per year over the forecast period. This is why, in our Current Measures scenario below, emissions fall to 2035 despite production increasing.

- Any further emissions intensity improvements as a result of carbon capture (in the second two scenarios) are layered on top of this 1%.

- We believe this to be an optimistic assumption with regards to emissions intensity given that firms have likely exhausted cheaper abatement technologies, and recent movesby the Government of Alberta have further weakened the TIER market.