EDMONTON, AB — Investor confidence in Alberta’s renewables sector is lagging behind peer jurisdictions, according to a new report from the Pembina Institute.

Two years of policy and regulatory uncertainty, which began in 2023 with the surprise seven-month moratorium on new wind and solar projects, and continues to today with a wide-reaching restructure of Alberta’s electricity market and legal challenge of federal electricity regulations, appear to have dampened investor confidence in wind, solar and battery project proposals in the province.

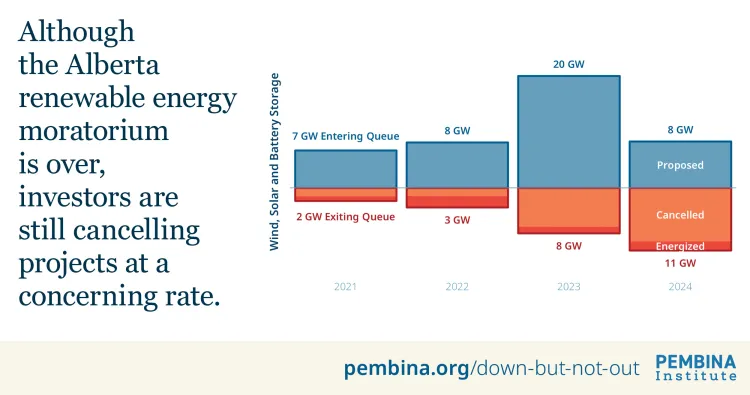

The report, Down But Not Out, examines data from the Alberta Electric System Operator’s (AESO’s) project connection queue over the last four calendar years (2021-2024), encompassing the period before and after the moratorium. As new projects are proposed, the queue grows. As projects are completed or cancelled, perhaps because an investor has lost interest or confidence in the market, the queue shrinks. This therefore provides a high-level overview of investment interest in Alberta’s electricity sector over time.

It finds that, for the first time, in 2024 the overall volume of projects in the queue shrank. While proposed projects are now back at pre-moratorium levels, there is a concerning increase in the number of projects that have been cancelled by investors.

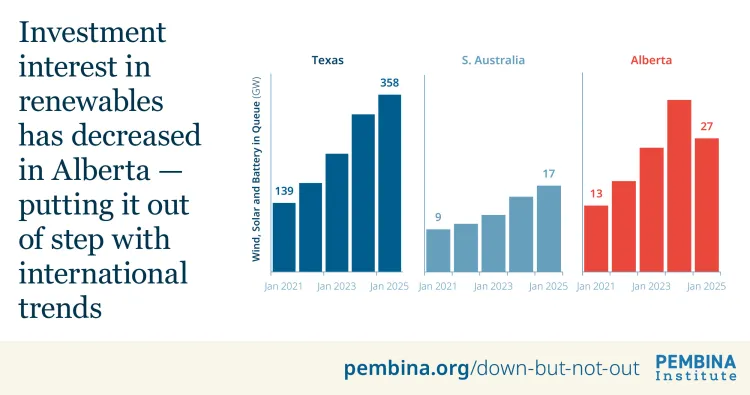

In contrast to Alberta, the report finds that peer jurisdictions that have similar market rules and regulations, such as Texas and South Australia, are showing evidence of steadily growing queues, alongside steadily growing renewables generation and energy storage capacity. These are signs of a healthy market where investors are confident in the trajectory of the jurisdiction’s policy and regulatory outlook over the next few years.

These other jurisdictions offer useful comparisons because, despite their differing sizes relative to the Alberta electricity market (Texas’s is five time larger than Alberta; South Australia’s is five times smaller), both already have much higher penetrations of wind and solar powering their grids (currently 32% and 71% respectively, compared with Alberta’s 18%). This demonstrates that, when the regulatory and investment conditions are stable, investment in renewables and energy storage is likely to flourish, regardless of the size of an electricity market or proportion of renewables already installed.

Quotes

“Right now, Alberta should actively seek out every potential investment dollar available to it, as it braces for the long-term impact of tariffs on its export sectors. There is strong evidence that Alberta has weakened renewable energy investments through its actions to date. The good news is the growth in low-cost renewable electricity is continuing elsewhere in Canada and the world, so those dollars are still there for the taking, if the Government of Alberta works to restore market confidence quickly.”

— Scott MacDougall, Director of the Pembina Institute’s electricity program

“When it comes to electricity, Alberta is swimming against the tide. Other governments in Canada are taking active steps to grow their supply of low-cost power, attracting investment in renewables and updating regulations and policies to make their grids more flexible and efficient. Restoring investor confidence in the renewables sector has to be a priority item for this government, to ensure Albertans aren’t left out while Canadians in other provinces experience the benefits of low-cost, abundant, reliable energy to power their lives for years to come.”

— Will Noel, Senior Analyst, Pembina Institute

Quick facts

- From 2020-2024, 86% of the national total of new wind, solar and battery storage installations in Canada were in Alberta.

- However, 2024 is the first year that the overall volume of renewables and batteries in Alberta’s renewable project proposal queue shrank, even as interest in renewables continued to increase globally

- Meanwhile, other provinces in Canada are taking steps to grow their electricity supply with large calls for clean power. For example, the British Columbia 2024 call for power awarded contracts to nine wind projects and one solar project, which will increase the supply of renewable electricity in B.C. by 8% when complete. Similarly, Ontario awarded contracts to ten battery storage projects in its LT1 capacity procurement in 2023.

- Peer jurisdictions like Texas and South Australia both have much higher proportions of their electricity demand met by wind and solar (currently 32% and 71%, respectively) than Alberta does (18%). Nevertheless, investor interest in new renewables, and especially energy storage projects, continues to grow in both Texas and South Australia.

[30]

Contact

Alex Burton

Communications Manager, Pembina Institute

825-994-2558

Background

Media release: Alberta’s electricity market restructure remains a source of investment uncertainty

Media release: Alberta is out of step with the global push to build modern electricity systems

Blog: Alberta is swimming against the tide on clean electricity

Report: Creating (Un)certainty for Renewable Projects