When governments make decisions about something we use every day, all day, we generally don’t want them to choose the more expensive, riskier options.

Unfortunately, taxpayers, ratepayers and businesses could spend decades paying more for electricity than they need to if the Ontario government continues on the path of their big-picture Integrated Energy Plan, released this summer. It spells out strong preferences — for more natural gas-fired power in the short term and nuclear generation in the long-term.

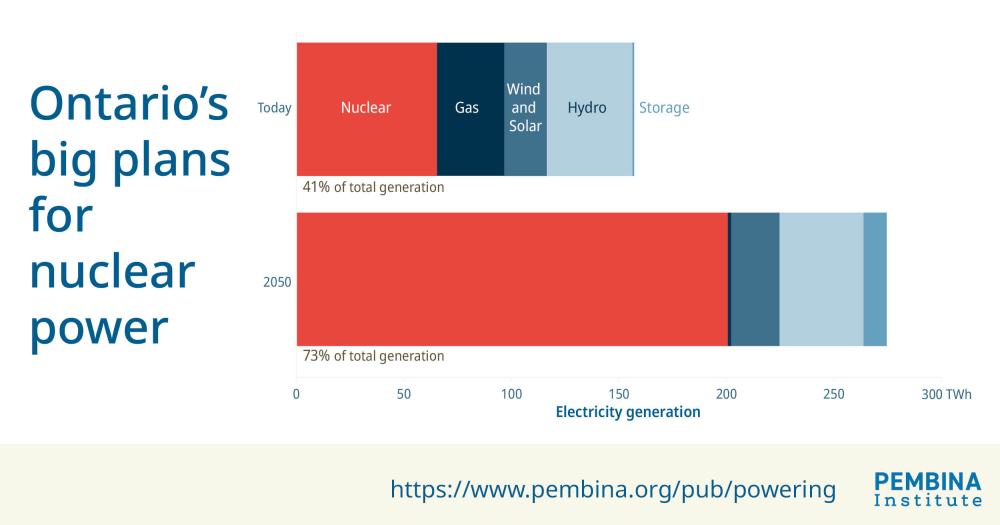

Projected growth in nuclear generation (2026–2050)

Data source: Independent Electricity System Operator

Mounting costs for nuclear generation

Last month, Ontario taxpayers saw electricity subsidies increase by $2 billion thanks, in large part, to nuclear costs. Then, last week, the government announced a $26.8 billion refurbishment for the Pickering nuclear power plant. All this could be a preview of what’s to come because Ontario’s energy plan doubles down on nuclear generation, adding more new nuclear generation than all of Ontario’s currently installed plants.

This big bet on an expensive technology conflicts with the government’s goal of “affordability first” in their energy plan. That’s because experience indicates that nuclear projects are almost certain to come in late and over their already high budgets, as we note in our new report Powering ON: Examining Ontario’s Integrated Energy Plan.

Plummeting renewable energy costs boost potential of wind, solar and batteries

There are other options. Renewable energy has undergone a complete cost metamorphosis in the last 15 years: solar costs plummeted 88 per cent and wind costs dropped 74 per cent. In tandem, their reliability-boosting energy storage partners — lithium-ion batteries — plunged 90 per cent in price. This is why 93 per cent of new electricity infrastructure being built in the United States this year is solar, wind and batteries. It’s also why renewable energy recently beat out coal as the largest source of electricity worldwide.

Renewable energy has outcompeted nuclear generation for years. That competitiveness remains even when you factor in pairing wind and solar with storage or other technologies to supply the grid with power when the sun sets or the wind doesn’t blow, as many jurisdictions around the world already do. Ontario has already proven itself a leader in harnessing storage and shows every intention of adding more as it grows its domestic supply chain from mining to manufacturing.

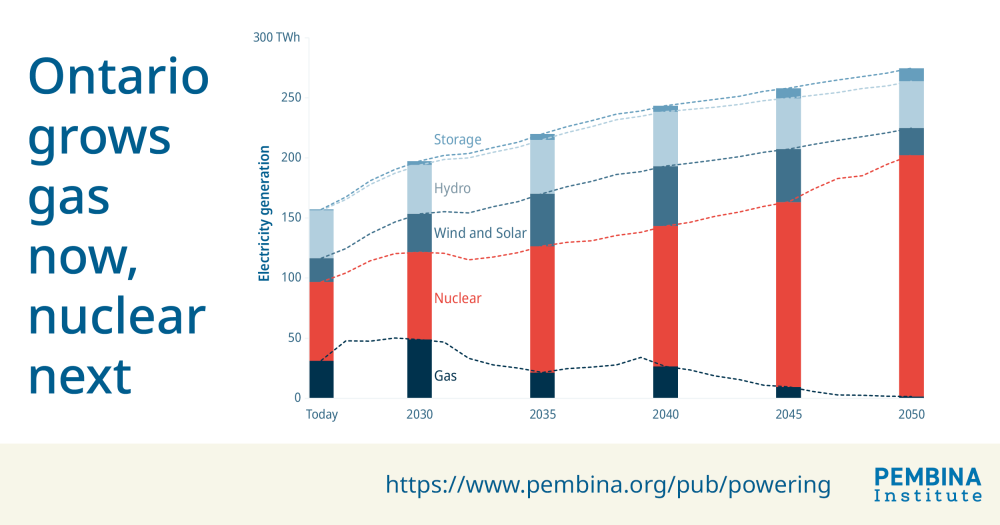

That wind-solar-storage partnership is also already cost-competitive with new gas plants in Ontario. In the existing plan, the province plans to boost natural gas generation by almost 50 per cent so it fills a quarter of the province’s electricity needs by 2030 before the new nuclear plants come online. The longer the delays, the more gas is likely to fill the gap. And delays are likely, as new nuclear plants, on average, come online six years late and at double the initial estimated cost.

The risks of relying on natural gas generation in Ontario

The risks of relying on natural gas generation are twofold. For one, 70 per cent of the gas Ontario currently uses comes from the U.S. As we know, dependencies like this represent an energy security risk when trade relationships abruptly sour. The rest of the required natural gas comes from Alberta, but it’s more expensive. So, choosing to use more Alberta gas would mean a jump in electricity prices, too. In either case, it’s sending money outside of Ontario that could be invested in local energy projects across the province.

Modelled evolution of Ontario’s electricity generation mix by IESO based on government policy direction (2025–2050)

Source: Independent Electricity System Operator

The potential of Ontario's latest long-term energy procurement

It’s not too late for Ontario to substitute a portion of their planned natural gas and nuclear generation with more affordable options. The province closed its latest submission proposal window for new energy projects on October 16, as it gears up to meet an expected 75 per cent increase in electricity demand by 2050. It committed to a transparent selection process in which a technology-agnostic lens would be used to secure the lowest-cost energy resources. Nuclear power, though, gets approved outside of this process.

Their decisions about the winning proposals through this and consecutive planned proposal windows will show up on hydro bills, taxes and provincial debt. And right now, the plan leans towards pricey, high-risk options. The solution? Mix in more wind, sun and batteries — already recognized as cost-cutting champions worldwide.