Canada’s Supreme Court is about to decide who is really on the hook for environmental liabilities in a case that pits the Alberta Energy Regulator (AER) against a bankrupt oil company’s creditors. The decision could set a dangerous precedent for insolvent companies and their bankers to walk away from liabilities and leave other companies — and potentially taxpayers — to foot billions of dollars in cleanup costs.

For Alberta’s government, the question has immense implications for fiscal responsibility, environmental management, and public safety in a context where environmental liabilities from tens of thousands of inactive conventional oil and gas sites left on the landscape have accumulated.

The Redwater legal case

Redwater Energy Corp. was a small Alberta-based oil and gas company founded in 2009 that declared bankruptcy in 2015. According to provincial legislation, when it did so, the company’s secured creditor ATB Financial and receiver Grant Thornton LLP became responsible for paying the cleanup costs at the company’s facilities and pipelines.

However, the lenders argued that instead of paying for site reclamation, they should be permitted to pocket the profits from the sale of Redwater’s remaining assets and leave the mess behind for the industry-funded and government-backed Orphan Well Association to deal with. The Alberta Court of Queen’s Bench ruled in the creditors’ favour in 2016. The AER contests the notion that repaying loans is a higher priority than public safety and environmental reclamation, and appealed the decision to the Supreme Court.

Alberta's liability iceberg

Wells, pipelines, facilities, or associated oil or gas sites that do not have a legal owner are all called “orphan wells” in Alberta. Due largely to sharp drops in global oil prices and ensuing bankruptcies, the number of orphan wells in the province has exploded from 162 in 2014 to over 3,700 in late 2017. This resulted in the provincial government issuing a $235 million dollar loan in May 2017 to the Orphan Well Association, a non-profit organization to manage these sites that is funded with levies on oil and gas producers. While the loan allowed the Orphan Well Association to manage its large inventory for a few years, the early 2018 bankruptcy of Chinese company Sequoia Resources Corp. threatens to follow the precedent set by the Alberta Queen’s Bench 2016 ruling on Redwater and offload as many as 3,000 additional properties as orphans.

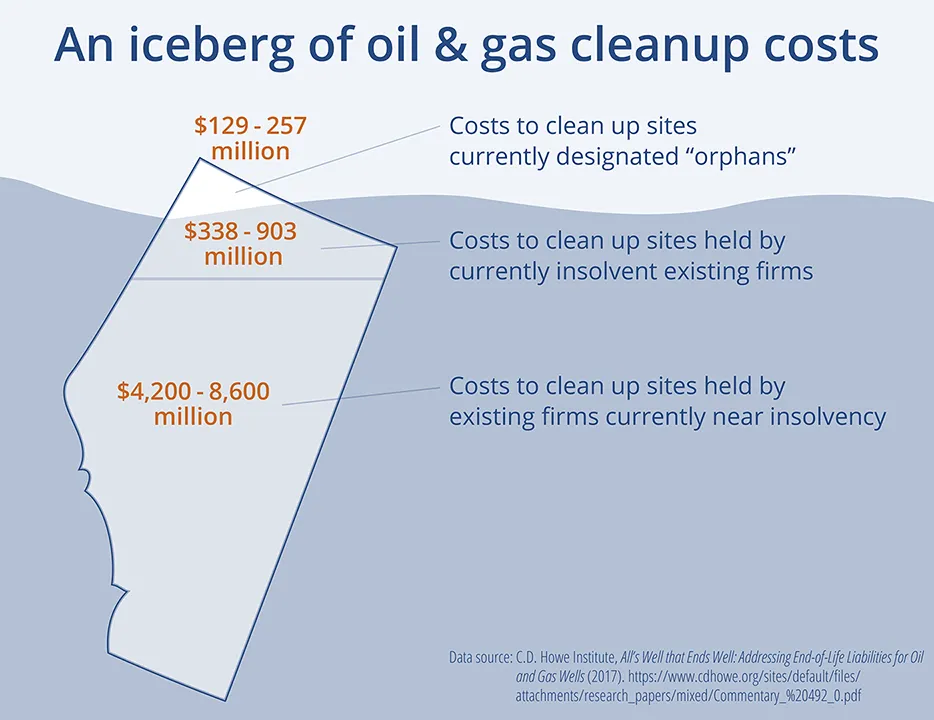

While the orphan well problem has gained traction in the media and government in recent years, there is a less known and much bigger oil and gas liability crisis is lurking just “below the surface.” According to the CD Howe Institute, of 450,000 conventional (i.e. non-oilsands) oil and gas wells registered in the province, a third ( over 155,000) are no longer producing and have yet to be fully cleaned up.

This issue has manifested because unlike many other oil and gas producing jurisdictions, Alberta does not have laws dictating timelines for companies to reclaim inactive well sites, so many of these sites linger for decades at the expense of landowners and the public. Not only do these non-producing sites incur opportunity costs by rendering land unusable, they also pose explosion hazards, release harmful air pollutants and greenhouse gases, and potentially contaminate soil and water. The Canadian Association of Petroleum Landmen points out in a 2017 article that compounding these risks is the reality that many of these sites are now held by less financially solvent firms. In some cases these liabilities get divided up and handed off into the ownership of barely solvent “zombie” companies that risk bankruptcy under relatively mild financial stressors.

A recent report by CD Howe estimates total cleanup costs for the backlog of Alberta’s inactive sites held by firms that are already bankrupt or on the brink of insolvency could be as high as $8 billion. The Redwater case has catapulted this problem onto the national stage by raising the question of who is responsible for paying that bill.

Is the liability iceberg about to surface?

Alberta’s hidden $8 billion bubble of inactive and non-reclaimed well sites could burst if economic conditions shift, pushing barely solvent zombie companies into bankruptcy and leaving the province to manage the liabilities. The onslaught of bankruptcies and 2,200 per cent increase in the number of orphan wells following the 2014 international oil price downturn is a foreboding signal of what could be in store. The outcome would be all the more dire if the Supreme Court rules creditors come before the environment, as it will give weaker companies and their lenders an incentive to declare bankruptcy in order to offload financial responsibility for the damages incurred by their operations.

In my next blog in this series, The Catch 22 of the Redwater case for Alberta's oil and gas industry, I discuss how the system has historically failed to manage oil and gas liabilities in Alberta and how we can chart solutions moving forward. And in the third blog, the immense legal, fiscal, and environmental impacts the Redwater case will have far beyond Alberta’s conventional oil and gas sector.