It’s a happy coincidence of timing: we need a lot more electricity generation, and fast — and we’ve also experienced more than a decade of price reductions in renewable energy.

A look at projects built in Canada shows a clear trend: contracted energy costs from wind and solar have been cut in half over the last 10 years, the period of time during which most projects were built in Canada.

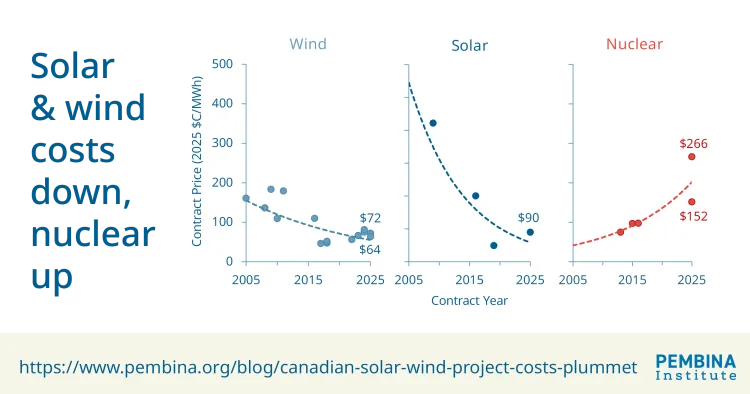

These wind and solar projects provide concrete, local examples of how costs are coming down as the technology improves and the market matures. Each point in the graph below reflects one or more real projects from signed deals. Altogether, the deals come from procurements in seven provinces across Canada.

The utilities that operate the electricity systems in most provinces held competitive procurement processes to secure contracts. This gave the market the certainty to grow and build projects that deliver low-cost energy. To top off all that good news, analysts expect that the cost of renewables will continue to drop further by between 25 to 50 per cent over the next decade.

In contrast, the cost of new nuclear projects, including refurbishments, has risen over the same period, so that the energy delivered by nuclear projects contracted over the last couple of years will likely be two to three times the cost of energy from renewables projects contracted in that year. We estimate the Pickering nuclear refurbishment will deliver power at $266 per megawatt-hour (MWh), and the Darlington small modular reactor project will be $152 per MWh; compare that to wind and solar procured in Saskatchewan and B.C. at $64-110 per MWh.

It's worth noting, too, that the energy from renewables will come along sooner — in the next three to five years — rather than 10 years or more for nuclear projects. It’s important to move quickly as forecasts across the country show a rapid and substantial increase in the need for additional electricity. For example, Ontario expects electricity demand will grow by 75 per cent by 2050, while Alberta expects a 26 to 44 per cent increase between 2024 and 2043.

Why the timing of the renewable energy price drops matters

A decade ago, wind and solar electricity generation were more expensive than other types of generation. But since then, prices have dropped steadily. Now, they’re the lowest-cost form of new electricity generation, according to the grid operators in Alberta and Ontario, as well as global analysts.

The timing of this price drop could not have come at a better time. Electricity demand is surging to accommodate the electrification of vehicles, home heating and industrial processes, so provinces across Canada are making crucial decisions about how to add more electricity to their systems. Getting more affordable electricity generation onto the grid — fast — underpins the competitiveness of the economy.

How electricity users benefit when renewable energy is added to the grid

Even if solar panels or wind turbines are not on your shopping list, your budget can still benefit from a growing clean energy sector. That’s because when the most affordable forms of new electricity generation — namely solar, wind and battery storage — are added to the electrical grid in your province or territory, they help keep electricity prices low for everybody.

The biggest cost involved in the life of a wind or solar farm is the upfront capital cost to build the infrastructure. Once they’re built, they run on free fuel (wind and sunshine), unlike natural gas or nuclear plants.

There are effective ways of making sure this low-cost energy is still available when the sun sets and the wind isn’t blowing. Ontario figured this out when it contracted 1,885 megawatts (MW) of battery storage capacity in its first long-term procurement. Extra wind and solar power is stashed away during peak energy-producing hours and is discharged to the grid when it’s most needed. The province is also harnessing energy savings by working with electricity consumers to reduce demand when necessary, and it’s building transmission lines to move energy from high production to high consumption areas.

The overall cost reductions of renewable energy over time and the continued low operating costs are the reasons why 93 per cent of new electricity infrastructure built in the United States last year was solar, wind and batteries. It’s also why renewable energy overtook coal as the largest source of electricity worldwide in 2025.

Where clean energy is being added to the Canadian grid now

Canadian provinces, having recognized the value of adding more renewables to their electricity mix, are scaling up calls for wind and solar project proposals in 2026. The fact that they’re using competitive auctions to secure the additional electricity means they’re getting the best value for their dollar. Here’s what we’ll be watching this year:

- Ontario: Over four years, the province is running a technology-agnostic competitive bid process for up to 7,500 MW of new energy and capacity. It’s open to wind and solar developers, as well as energy storage projects and natural gas plants. The first round of results are expected in April.

- Quebec: Hydro-Québec announced plans last year to develop 10,000 MW of wind and 3,000 MW of solar energy by 2035. The first call for tenders for 300 MW of solar energy is opening in April.

- British Columbia: BC Hydro launched a bid process in 2025 to acquire up to 5,000 gigawatt hours per year of new clean or renewable energy projects. For comparison, this is roughly equivalent to either 1,600 MW of wind or 2,500 MW of solar. BC Hydro got 14 proposals totalling more than 9,100 gigawatt hours per year, nearly double the targeted amount, and final results are expected in the coming months.

- Manitoba: Manitoba Hydro is procuring 600 MW of wind power this year, with the official request for proposals coming out in March.

- The territories do not have centralized renewable energy requests for proposals. They’re typically smaller community-oriented projects, funding programs, and utility procurements rather than large multihundred-MW auctions. Our recent report, Restoring the Flow, explores the status of policies supporting Indigenous-led clean energy in remote communities.

However, a couple of provinces are choosing to go a different direction with new energy needs and are missing out on the opportunities of low-cost renewable energy:

- Alberta: Until recently, Alberta led the country in renewable energy deployment. However, after a series of major policy changes, the market is stalling, as our report from last year highlights.

- Saskatchewan: The Government of Saskatchewan decided in the middle of last year to extend its coal fleet to power its grid until nuclear plants come online sometime later in the century. Although it is also procuring some renewable energy, we believe the decision to extend coal is going in the wrong direction.

The provincial and territorial governments with the foresight to take advantage of the low-cost electricity available from wind and solar can do so by planning their systems around a modernized grid. This means harnessing the latest technology — including interprovincial interties, demand-side measures and long-duration energy storage — to manage their energy in a way that delivers affordable and reliable electricity as demand grows.

2026 will be another exciting year for clean energy in Canada as federal, provincial and territorial governments adjust to the new reality of low-cost renewable energy and make crucial decisions about the future of our energy supply.

HOW WE DID IT: Calculating contract renewable and nuclear energy costs in Canada

Contract prices for wind and solar were compiled from various publicly available sources. For the most part, contract (strike) prices are from deals procured or offered through a government or government agency, such as a system operator (e.g., Alberta Electric System Operator, Independent Electricity System Operator) or Crown corporation (e.g., BC Hydro, NB Power). As we do not have line of sight on contract prices for private power purchase agreements, this is our best estimate for the evolution of wind and solar costs for Canadian projects.

Nuclear projects are slightly different. Due to the size and capital requirement of these projects (especially relative to wind and solar), all nuclear offtake agreements will typically involve a provincial government and electricity system operator (or equivalent Crown corporation). For these, contract prices were found through publicly available procurement contracts, rate-applications made to a utility commission or energy board, or in applicable provincial regulations.

To ensure a fair comparison over time, contract prices were all converted from their published values to 2025 Canadian dollars per megawatt-hour ($/MWh) using the Bank of Canada's inflation calculator.

Gas plants were not included as there are no Canadian public procurements we are aware of for new plants providing energy services to the grid, though there are many examples of them providing capacity services. This is a better comparison for energy storage rather than renewables or nuclear, which are about delivering energy.