CALGARY, AB — A new report from the Pembina Institute finds that global demand for oil is likely to enter into long-term decline before 2030.

The future of oil in the energy transition brings together modelling from a range of different sources – including global research bodies such as the International Energy Agency (IEA), Rystad Energy and Bloomberg, as well as oil majors bp and Equinor. All these institutions look at trends in government climate policies, technological development, and shifts in consumer behaviour to model various scenarios for oil demand between now and the landmark climate year of 2050 – by which time numerous countries, including Canada, have committed to reducing their greenhouse gas emissions to net-zero.

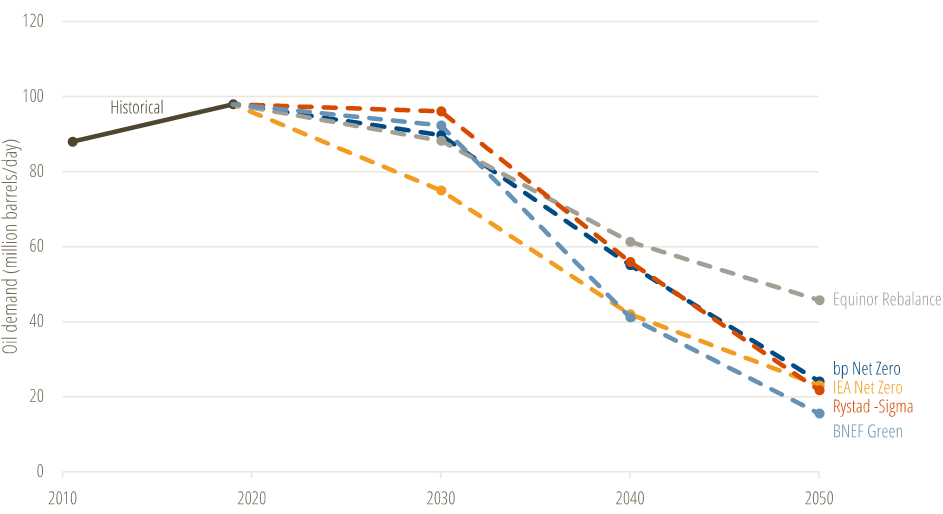

- Even in the least ambitious scenarios, which assume that no new climate policies or regulations are adopted beyond those that already exist, all institutions in the report – including from the oil industry – project that global demand for oil will begin long-term decline before 2030.

- In scenarios which assume that the scale and pace of the energy transition continues as it has in the last few years, by 2050, the projected decline ranges from 17%-51% down from 2019 levels.

- Meanwhile, in scenarios where countries successfully reach net-zero emissions by 2050 – or where global warming is limited to two degrees Celsius (the limit required to avoid the worst impacts of climate change) – the projected decline ranges from 54%-84% down from 2019 levels.

Oil demand if countries reach Net-Zero by 2050, or global warming is limited to 2 degrees Celsius. (Figure 2 from The future of oil in the energy transition).

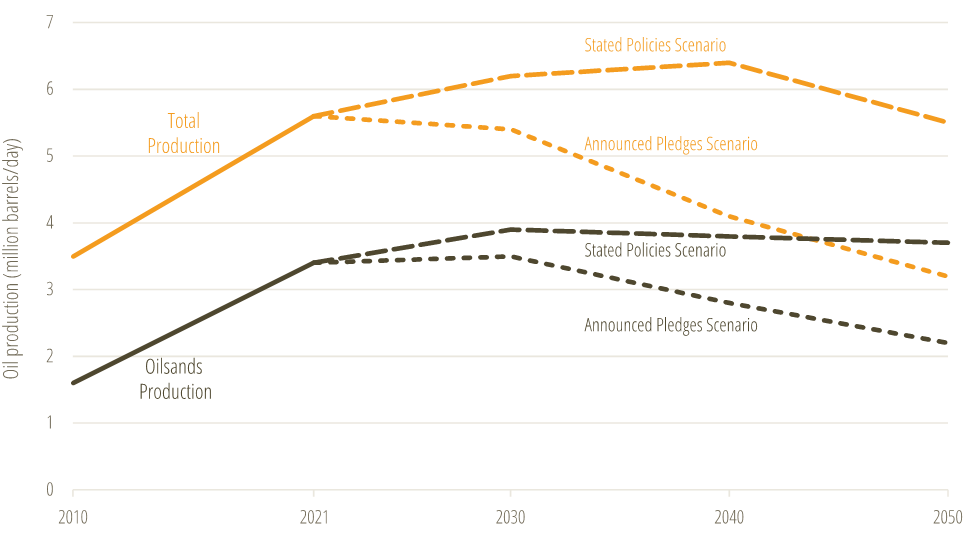

For Canada’s oil industry in particular, data from the IEA shows that – even in scenarios where Canada falls short of its net-zero targets – oil production slows this decade, and declines before 2050.

Canadian oil production (with oilsands as a sub-set), under existing policies (Stated Policies Scenario) and if the pace of policy changes continues along the trajectory witnessed in the last few years (Announced Pledges Scenario). (Figure 8 from The future of oil in the energy transition.)

The report further outlines the drivers of this demand decline, including:

- The rapid fall in demand for oil for road transport, due to the continued accelerated uptake of electric vehicles (one estimate suggests that electric vehicles will be cheaper to buy than gasoline-powered vehicles by as early as 2026 in most countries).

- The growing pace of global climate action, with a rapid growth in the number of net-zero targets either announced or in legislation globally – and accompanying regulations aimed at reducing greenhouse gas emissions, including shifting away from a reliance on fossil fuels.

- The unclear future of demand for plastics (oil is used as a feedstock by the petrochemical industry to make plastics), given the introduction in numerous countries of policies around recycling and the circular economy. Demand for plastics is already no longer increasing in OECD markets—which in 2021 made up nearly half of all plastics demand.

Quotes

Janetta McKenzie, Senior Analyst at the Pembina Institute and author of The future of oil in the energy transition, said:

“For the first time, a range of credible institutions – including from the oil sector – agree that we are heading for a near future of reduced demand for oil. The question is only the scale and pace of that decline. And, unlike in the boom-and-bust cycles of the past, this decline is based on significant, long-term social and economic trends – meaning demand is projected to start falling during this decade, and is unlikely to resurge.”

“While 2022 has been tumultuous for energy markets, looking back over this year we can see clear examples that Russia’s invasion of Ukraine has had the effect of spurring – not slowing – climate action. Governments and companies are recognizing that a solution to the three interlinked crises of energy security, climate change, and energy affordability is substantial investment in clean energy and clean technologies, coupled with a reduced reliance on fossil fuels.”

“Being clear-minded about the future of the oil sector is crucial for government and industry decisionmakers in Canada. Recognizing the inherent risks of investment in a sector with such an uncertain future will allow Canada to make well-informed choices about where to put public and private capital – to ensure that Canadians reap the benefits of the clean economy, and don’t end up financially liable for future stranded assets in the oil sector. This also reinforces the need for strong policies that regulate emissions in our oil and gas sector, such as the federal emissions cap, to ensure companies are taking steps to futureproof their operations for a low-carbon energy world of the near future, where oil that has the least associated emissions (such as that produced using carbon capture technology, electrified industrial processes, and near-zero methane emissions) will be best-placed to service reduced levels of demand.”

Pembina Institute experts are available for interviews and comment.

[30]

Contact

Alex Burton

Communications Manager, Pembina Institute

825-994-2558

Background

Report: The future of oil in the energy transition

Blog: Big lessons for Canada's energy sector in this year's World Energy Outlook report

Op-ed: Why the federal oil and gas emissions cap is a win for Albertans