The International Energy Agency released the latest annual edition of its landmark World Energy Outlook last week. The WEO is used by researchers, academics and policymakers worldwide to assess how our energy system is currently functioning, how it may evolve in the coming decades, and what policies and regulations can be put in place to shape its future in the way governments want.

With most developed nations (including Canada) now committed to reaching net-zero greenhouse gas emissions by 2050 – and in the run-up to COP27 climate talks this month – the release of the WEO is a key moment to consider how changes to our energy production and use can (and must) contribute to our climate goals. Additionally, the Canada Energy Regulator has been mandated with creating a net-zero scenario for Canada in the next iteration of its Energy Futures report, and there are crucial lessons to be learned as this scenario is developed.

Scenarios, not predictions

In the WEO, the IEA presents three scenarios for how the global energy system may evolve in the coming decades:

- The Stated Policies scenario (STEPS) examines the impacts of policies that governments have already implemented (like those announced in Canada’s 2030 Emissions Reduction Plan). This is the least ambitious scenario – it is useful to think of it in terms of “if we did nothing more than what we’re already doing, how would our energy system look in the next few years?”

- The Announced Pledges Scenario (APS) speeds up that transition and assumes that all announced climate goals around the world will be met in full and on time. This is different from STEPS in that it includes the possibility that governments will implement more policies than those they’ve already put in place.

- The Net Zero Emissions by 2050 Scenario (NZE) is a cost-effective pathway modelled by the IEA, through which the world’s energy sector would achieve net-zero emissions by 2050, and emissions would be reduced to a level where we would have a 50% chance of limiting global warming to 1.5 degrees above pre-industrial levels. The 1.5 degree target has been identified by scientists as a crucial threshold, beyond which we risk more severe impacts on global ecosystems.

Crucially, the IEA’s scenarios are not predictions. They are modelled trajectories that use data to highlight key trends, uncertainties, and potential outcomes. They can help us stay on track with our climate goals and identify where more work needs to be done.

Energy security versus climate action?

Questions about the world’s progress towards net-zero, and how that progress may be hindered by Russia’s invasion of Ukraine earlier this year and the energy price crisis that followed, have dominated discourse in Canada’s energy sector for several months. With the prospect of blackouts in some European countries this winter, caused in part by a lack of supply of natural gas from Russia, some proponents of fossil fuel industries have sought to argue that the world’s immediate energy security needs will have to trump longer-term concerns about emissions reduction and the transition to clean energy.

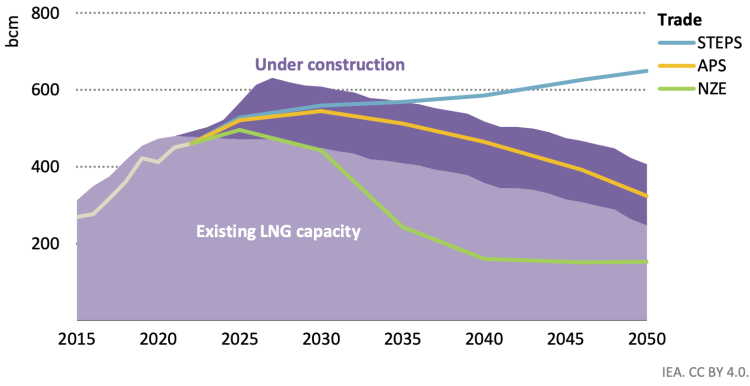

We have seen, for example, calls to increase exports of oil and liquefied natural gas (LNG), to help ease the global supply crunch – with some proposed projects to develop related infrastructure. But in the STEPS scenario, we already have enough LNG capacity from existing projects and those under construction to at least 2035. In the net-zero scenario, we already have more capacity than will be needed. And the infrastructure required to process and ship LNG from Canada would likely not come online until the mid- to late-2020’s, which will not address immediate energy security concerns.

Figure 1: Existing and under construction LNG capacity and total inter-regional LNG trade by scenario, 2015-2050 (IEA 2022, Fig. 8.8)

The key question is: has the war in Ukraine fundamentally changed the outlook for the energy transition?

On this front, the World Energy Outlook has some key insights. Despite volatility in the global energy system, it finds that we have actually improved our emissions trajectory since last year. The energy price crisis is introducing uncertainty into the system and will likely result in a turbulent couple of years, especially in the European Union. However, the IEA notes that clean energy is the best way to ensure long-term energy security, by reducing our reliance on fossil fuels. This chimes with the fact that some European countries are fast-tracking their investments in renewables and other energy transition policies. For instance, in April 2022 Germany introduced a broad set of energy reforms with the dual purpose of meeting climate targets and phasing out Russian oil and gas imports, which included 35 billion euros earmarked for funding renewable electricity. To the same end, Germany also announced its intention to have an electricity grid fully powered by renewable energy by 2035, in line with Canada’s similar commitment to achieving a net-zero grid by the same date.

Fossil fuel demand set to fall

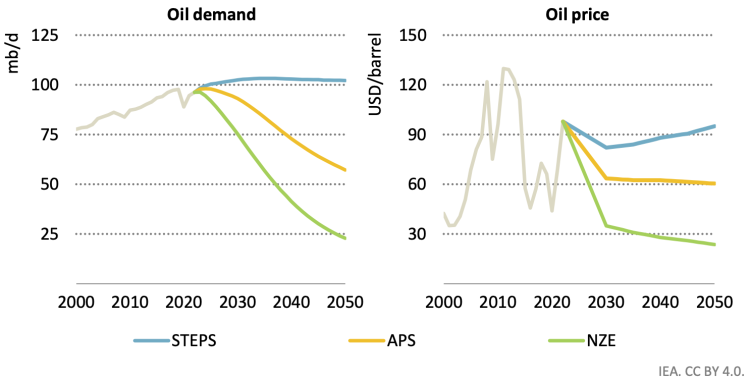

For the first time in WEO history, all three scenarios show a plateau and decline in global demand for oil, natural gas and coal by 2030. In the STEPS scenario, the least ambitious of the three, the share of fossil fuels in the global energy mix falls to about 60% in 2050, compared to around 80% today (as it has been for decades). This means more countries are getting more ambitious about reducing energy sector emissions, and are implementing policy to support their pledges.

Figure 2: Global oil demand and crude oil price by scenario (IEA 2022, Fig. 7.1)

Driving that fall in oil demand is uptake in electric vehicles – given that road transport is responsible for more than 40% of oil demand today. As of 2022, 36 countries have announced target dates to stop sales of gasoline vehicles, including Canada. In the APS, which assumes those target dates are met, two-thirds of new car sales are electric by 2040.

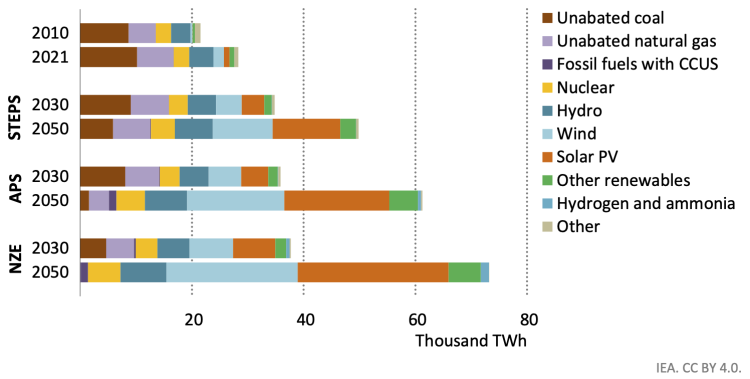

Aside from transportation, much of the modelled fossil fuel demand decline – and associated emissions reductions – are driven by uptake in clean electricity. Even in the STEPS scenario, wind and solar are projected to overtake fossil fuels by share of global electricity generation as soon as 2030. Renewables also make up the majority of new generation capacity around the world from now to 2050.

Decreasing costs of wind and solar, combined with policy incentives aimed at scaling up renewable capacity, mean that natural gas is no longer seen as a “bridge fuel” between coal and renewables (in other words, a solution to get us from the electricity generation mix we have now to the low-emissions grid of the future). For example, the STEPS no longer projects growth in new gas-fired power stations between today and 2050.

Clean energy sector jobs set to keep growing

The decline of traditional energy industries, such as the phase-out of coal plants in Canada, has often been linked with concerns about job losses affecting energy workers. But it is also important to pay attention to the concurrent rise in jobs in the clean energy sector.

Clean energy jobs already exceed those in fossil fuels worldwide, and are projected to grow from around 33 million today to almost 55 million in 2030 in the APS. In all scenarios, the number of new jobs created outweighs the number of those lost in fossil fuel industries, although the jobs that are created may not be in the same places as those that are lost, and the required skills in many cases will be different. This demonstrates the scale of opportunity for job growth if governments embrace the transition and invest in skilling up workers to meet the demands of emerging industries.

Still lots to do

Our big takeaway from this year’s WEO is that momentum continues to build on climate action and adoption of clean technologies, despite a global pandemic and the devastating crisis in Ukraine which has upset energy. However, it is still clear that the clean energy transition needs to accelerate rapidly if we are to meet our overall climate targets.

The world is still far off its goal of limiting global temperature rise to 1.5 degrees. In the STEPS, emissions decline by about 13% to 2050, which would result in about 2.5 degrees of global warming by 2100. In the APS, fully implementing all announced national commitments would keep temperature rise to 1.7 degrees by 2100. These outcomes are better even than last year’s WEO, but also remind us that we still need to go faster and further in the next few decades. What may appear like small differences to the level of global warming will have significant consequences in terms of real world effects, and so we must keep our focus on avoiding the most severe impacts of climate change.

There also remains a massive investment gap for clean energy. Under the STEPS, global investment in clean energy reaches about US$2 trillion by 2050; under the NZE, an estimated US$4 trillion is needed. So, while we are working to reduce investment in fossil fuels, we need to support demand-side measures and investment in clean energy in parallel. If we reduce fossil fuel investment (and therefore supply) without ensuring that there is sufficient clean energy capacity available to meet that shifting demand, we can anticipate very high energy prices globally as supply and demand fall out of sync. With this in mind, it is welcome news that Canada’s federal government took steps in the Fall Economic Statement this week to develop its investment tax credit for hydrogen, storage and net-zero technologies (a commitment made in the April 2022 budget), to drive investment into clean power sources.

Figure 3: Global electricity generation by source and scenario, 2010-2050 (IEA 2022, Fig 6.7)

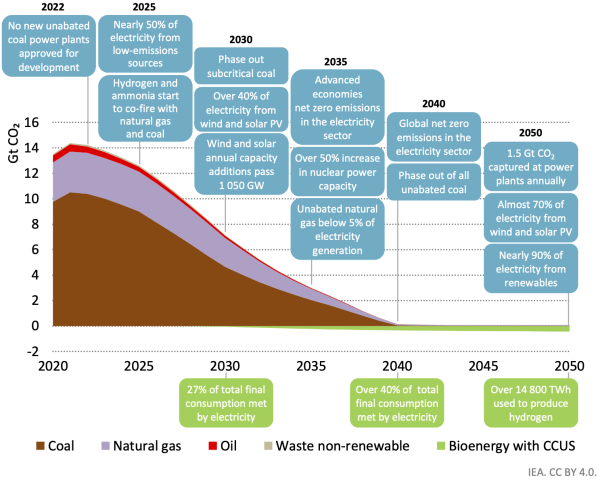

Finally, this is the first time the STEPS scenario does not project growth in gas-fired generation between now and 2050. In fact, in the net-zero scenario, we see that clean electricity becomes responsible for 90% of total generation, with an extremely limited role for natural gas. To achieve this, it is crucial that governments take steps to ramp up investment in non-emitting sources of system flexibility – such as battery storage, transmission infrastructure to connect different grids together (to allow Canada’s provinces to draw on each others’ supply during periods of varying demand), and energy efficiency measures on the grid.

Equally crucial is that this action takes place early, as we have pointed out – and as the WEO confirms – there are many critical milestones to hit if we are to achieve a net-zero electricity grid in Canada by 2035:

Figure 4: CO2 emissions by source and key milestones in the electricity sector in the NZE Scenario, 2020 to 2050 (IEA 2022, Fig 3.9)