EDMONTON — Clean energy projects cancelled since the start of Alberta's renewables moratorium could have generated more than Alberta's average total power demand (109 per cent), according to new analysis from the Pembina Institute.

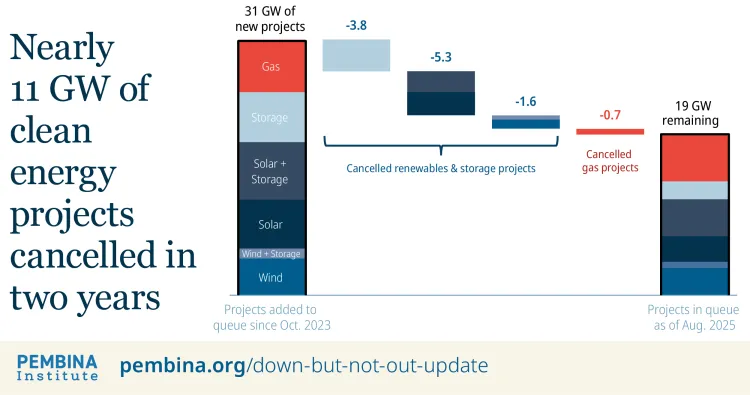

Since October 2023, projects amounting to almost 11 gigawatts (GW) of wind, solar and energy storage have been withdrawn from the Alberta Electric System Operator project development queue. Though not all proposed projects make it all the way to completion, cancellations for renewables over the last two years have been concerningly high, at 44 per cent. By comparison, 11 per cent of gas capacity proposed in the same timeframe has been cancelled.

This latest analysis is an update to Pembina Institute’s previous report, Down But Not Out (May 2025), in which we detailed the litany of challenges faced by renewable energy developers in Alberta. This includes outright bans and ambiguous restrictions on areas of land where wind and solar projects can be built, new requirements relating to equipment recycling and land reclamation, and changes to transmission legislation, all of which will likely add new regulatory burdens and upfront costs. It is notable that many of these new requirements are not equally applied to other industries, including other energy sectors such as oil and gas.

The Pembina Institute continues to make the following recommendations to the Alberta government, to revive investor confidence in its once-booming renewables sector:

- Direct regulators and government to create the rules and regulations to support a clean, resilient and affordable electricity system.

- Encourage investment in new projects by fast-tracking development for areas where utility-scale renewable projects would be particularly well-suited.

- Support energy independence and resilience by promoting the use of interties, energy storage, distributed energy resources, and demand-side management.

Quotes

“Renewable energy companies would have loved to keep investing in Alberta's economy with their wind and solar projects, but the regulatory and policy uncertainty is forcing developers to pull the plug on many projects. This means Albertans are missing out on millions of dollars of investment, tax revenues, and the lowest-cost forms of electricity generation. What is more, cancellations of renewables projects are now outpacing new proposals — meaning not only are developers leaving the queue, they're choosing not to join it in the first place.

“Clean energy investment is still happening — just not here. Nova Scotia has selected regions for up to 5 GW of offshore wind developments that it will be calling for bids for starting later this year. And the B.C. and Quebec governments have recently issued multi-gigawatt calls for new wind and solar projects.”

— Will Noel, Electricity program senior analyst, Pembina Institute

Quick facts

- The Alberta Electric System Operator’s project connection queue provides a high-level overview of investment interest in Alberta’s electricity sector over time. As new projects are proposed, the queue grows. As projects are built or cancelled, perhaps because an investor has lost interest or confidence in the market, the queue shrinks.

- Cancelled projects since October 2023 (the point after the onset of the renewables moratorium when the AESO accepted the first cluster of new project applications) represent almost 11 gigawatts of wind, solar and energy storage.

- The 11 GW represents 109 per cent of Alberta's average total power demand, or 89 per cent of peak power demand.

- Since the start of the renewable energy moratorium, however, the volume of gas projects in the queue has increased by 32 per cent. An increased proportion of gas on the grid would likely drive up the costs of electricity for Albertans. According to 2023 Clean Energy Canada analysis, wind and solar, with batteries, produce cheaper electricity than natural gas.

- Alberta is not in step with global trends. In 2025, global investment in wind, solar and battery storage is set to be more than five times that of investment in gas, oil and coal power, according to the International Energy Agency.

Contact

Hanneke Brooymans

Senior Communications Lead, Pembina Institute

587-336-4396

Background

Media release: Alberta’s electricity market restructure remains a source of investment uncertainty

Media release: Alberta is out of step with the global push to build modern electricity systems

Blog: Alberta is swimming against the tide on clean electricity

Report: Creating (Un)certainty for Renewable Projects

Report: I'll Have What They're Having: Lessons learned from six jurisdictions leading in wind and solar deployment