CALGARY — Direct jobs in Canada’s oil and gas sector fell by 35,000 in the decade to 2023 despite significant production growth during the same period, according to new analysis from the Pembina Institute.

Drilling Down: Oil and gas jobs in transition examines the period since the 2014 global oil price crash – a seismic event that, it is now clear, fundamentally altered Canadian oil and gas companies’ investment decisions.

The report finds that, post-2014, companies stopped investing in large sources of new production – the types of projects that had previously created upswings in employment and sources of revenue years and decades into the future. Instead, they adopted shorter-term outlooks, bolstering their market positions through mergers, acquisitions, and share re-purchases, and cutting costs through the consolidation of workforces and automation of some roles.

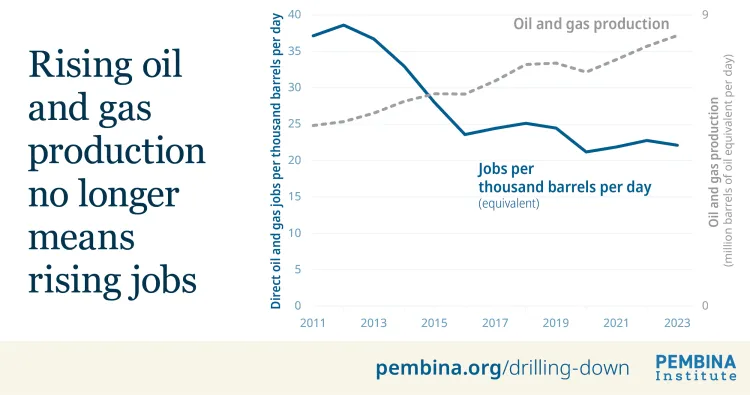

As a result, even as the oil price rebounded several times – including to a record high following Russia’s invasion of Ukraine in 2022 – production of oil and gas grew, but jobs in the sector no longer grew at the same rate.

In the decade to 2023, the number of jobs per barrel of oil (and natural gas equivalent) fell by 43%, while production increased by 47%.

The report also explores potential future jobs related to decarbonization of the oil and gas sector. Although modelling indicates that some 5,000-6,000 jobs in industries such as methane abatement and carbon capture deployment could be created by 2050, these jobs are contingent on oil and gas companies investing to significantly reduce their upstream emissions. At present, in the absence of sufficient regulations – such as strengthened industrial carbon pricing systems – companies are not yet compelled to make such investments.

Nevertheless, even in the report’s most optimistic scenarios, new jobs from decarbonizing oil and gas production will not fully replace those lost in the sector – particularly as the global energy transition speeds up and companies continue to cut costs. It is imperative, therefore, that governments – especially Alberta, which is more vulnerable to shifts in oil and gas employment – undertake workforce planning to leverage industries of the future that are aligned with global trends around low-carbon energy production and use. These sectors, including transportation, low-carbon buildings, direct air capture, clean electricity, biofuels, and low-carbon manufacturing, could account for tens of thousands of new jobs by 2030, reaching hundreds of thousands by 2050, if the correct policies are in place to allow these industries and workers to flourish.

Quotes

“As Canada weighs which nation-building projects to fast-track or even to subsidize, oil and gas expansion – often sold as a guaranteed path to prosperity – deserves more scrutiny. A decade of aggressive cost-cutting has caused a significant – and so far sustained – decline in jobs across the oil and gas sector, while production has increased.”

— Janetta McKenzie, Director, Oil and Gas, Pembina Institute

“The first step in supporting workers through the energy transition is to acknowledge the reality: overall employment opportunities associated with oil and gas production is declining. Our modelling points to major opportunities for private investment and job creation in low-carbon industries, but these will only be realised if governments commit to the shift and plan for it now.”

— Megan Gordon, Manager, Equitable Transition, Pembina Institute

Quick facts

- The absolute number of direct jobs in the oil and gas sector peaked in 2013 at 219,000. This had fallen to 184,000 by 2023 – a decrease of 35,000.

- Meanwhile, oil and gas production increased by 47% during the same period, from 5.7 million barrels of oil equivalent per day in 2012 to 8.4 million barrels per day in 2023.

- These factors – a significant increase in production levels accompanied by decrease in jobs – means by the end of the decade, the number of workers employed per barrel of oil (or natural gas equivalent) produced had sharply fallen.

- In 2005, as major production in Canada’s oilsands first got underway, there were about 25 jobs per thousand barrels per day of oil (and natural gas equivalent). This peaked in 2012, with 38 jobs per thousand barrels per day. This rapidly declined after the 2014 price crash, reaching 22 jobs per thousand barrels per day in 2023. As such, in the period from 2012 to 2023, jobs per thousand barrels per day decreased by 43%.

- In 2023, direct oil and gas jobs made up 5% of jobs in Alberta and under 1% of jobs in Canada. In comparison, manufacturing made up 9% of jobs in Canada.

[30]

Contact

Director, Communications, Industrial Decarbonization

825-994-2558