Our recent report, The future of oil in the energy transition, finds that global demand for oil is likely to plateau and decline before the end of this decade. The report’s author Janetta McKenzie, Senior Analyst at the Pembina Institute, explains what this finding is based on, and what it should mean for Canada’s business and political decisionmakers.

Q- Your report found that global demand for oil is likely to plateau and decline before 2030. What does that mean?

Trying to work out what the outlook is for oil demand is something that many groups — not least oil companies themselves — do on a regular basis. They produce what we call scenarios, which use data from the real world to try and estimate where oil demand might go over the next few decades, if certain changes in policy, technology, and behaviour do or do not happen.

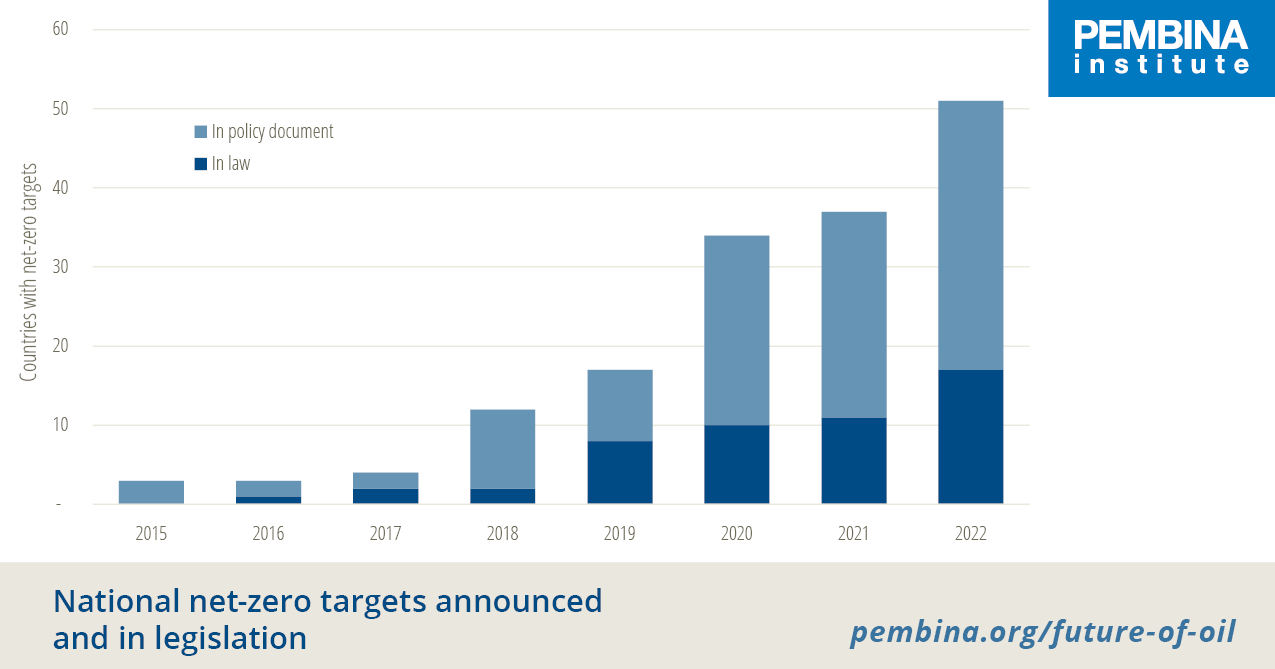

For example, since the Paris Agreement in 2015 — where 193 countries, plus all the member states of the European Union, signed the landmark pledge to keep global warming to 1.5 degrees above pre-industrial levels — there has been a steady growth in the number of climate policies introduced around the world that are supposed to help countries meet that target. In scenarios that assume this momentum of increased climate action continues along the same trajectory, more and more economies will be significantly reducing their fossil fuel use — precipitating a fall in global oil demand, starting this decade.

Q- Is it really possible to predict the future like that?

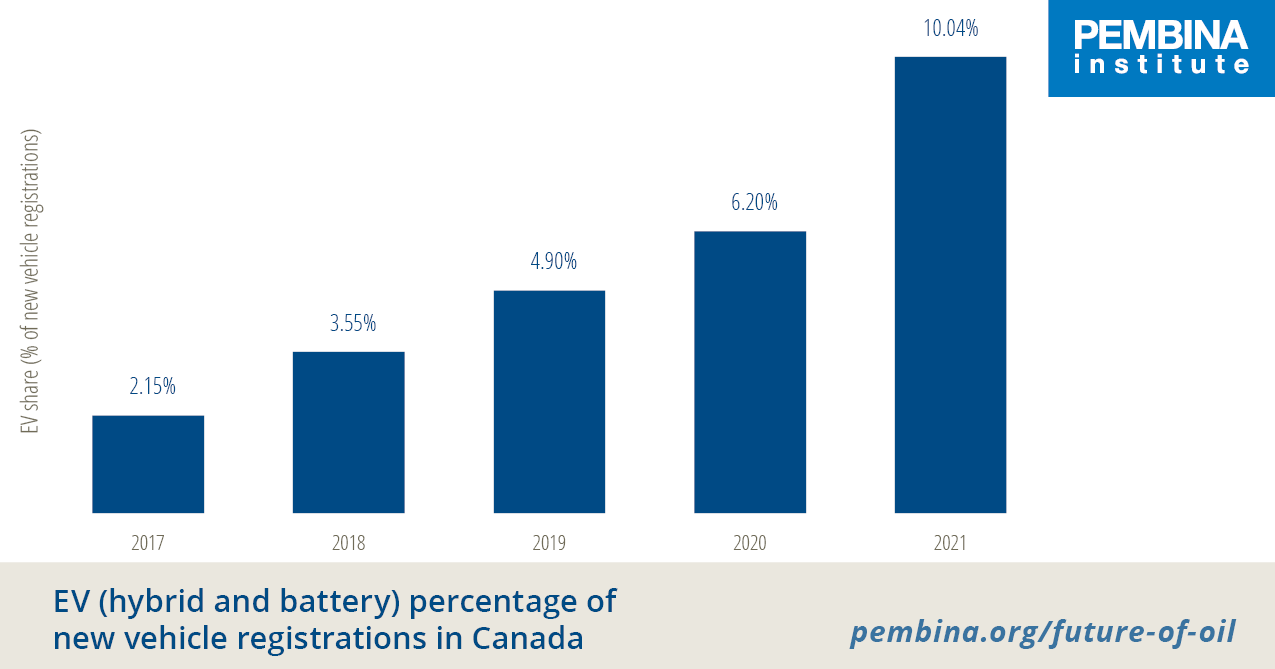

It’s important to remember that we aren’t predicting the future here. Instead, we’re looking at observable trends in the real world and gaming out how they are most likely to develop over the next few years. A particularly good indicator is the uptake of electric vehicles. Since gasoline fuel is one of our main uses for oil at present, the more people who switch from gasoline to electric vehicles, the bigger the impact will be on oil demand. And even though right now most cars on the road are still gasoline-powered, the uptake of electric vehicles is accelerating rapidly. That’s being helped by things like sales subsidies and mandates — such as those introduced by the Government of Canada, provinces, the U.S. and other countries — that aim to ensure that an increasing proportion of all new vehicles sold are electric, by a certain date. (In response, we’re seeing ever more vehicle manufacturers making the switch to all-electric fleets.)

Q- Your report says this is the first time that a range of institutions are projecting this — why is that significant?

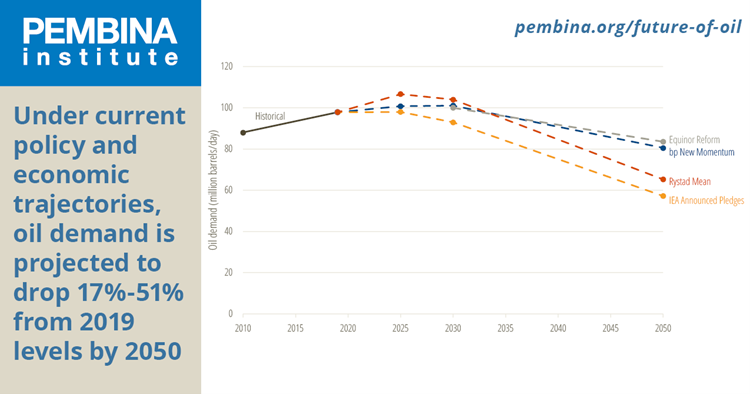

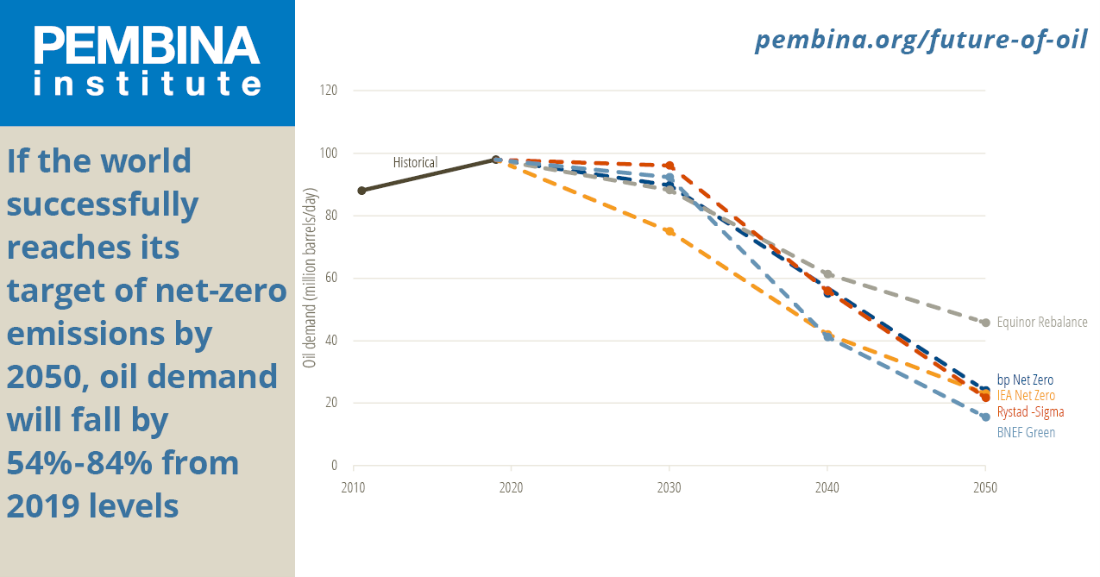

There’s always room for error in scenarios. Some things may not happen in the way we think they’re going to, or at the speed we’re expecting — so it’s important to have a range of different scenarios, produced by different modelers, so that we can compare and contrast. What is interesting here is that, for the first time, all the scenarios we looked at converged around the idea that oil demand will enter into long-term decline by the end of this decade (meaning it is not expected to rebound later). The only point of difference between the modelers is how steep and rapid the drop in demand ends up being.

Although all the scenarios we looked at came from credible, unbiased modelers, it’s also important to note how diverse they are. The International Energy Agency, for example, is a huge intergovernmental organization that does continuous research on all types of energy trends, not just oil. Bloomberg New Energy Finance and Rystad tend to aim their modelling at big businesses and other clients that are trying to make decisions about where is best to invest their money in the energy industry. Finally, oil companies like bp and Equinor have a vested interest in understanding the future of oil demand, for obvious reasons. The fact that all these different institutions are coalescing around the idea that oil demand will start to fall this decade is significant — because they’re giving independent assessments of the same issue, even though they (and the people who use their modeling) will each be affected by that oil demand decline in very different ways.

Q- Doesn’t oil demand just ebb and flow over the years? Albertans, for example, are used to boom-and-bust cycles. How is this different?

The first thing to say is that, when looking across the whole of the last century, the trend has clearly been that oil demand has been rising over time. Nevertheless, it’s true that short-term fluctuations in price and demand are something the oil industry has dealt with at various points. In the past, that has been mainly linked to economic cycles around the world — when countries’ economies are growing, new businesses are opening, new buildings and infrastructure are being constructed, new jobs are being created (meaning citizens are doing more travel and other things that require energy use), and so more oil is needed to power all that growth. On the other hand, when economies enter recession (or when there is a fear that recession is on the horizon), everything slows down and demand for commodities — including oil — tends to decrease.

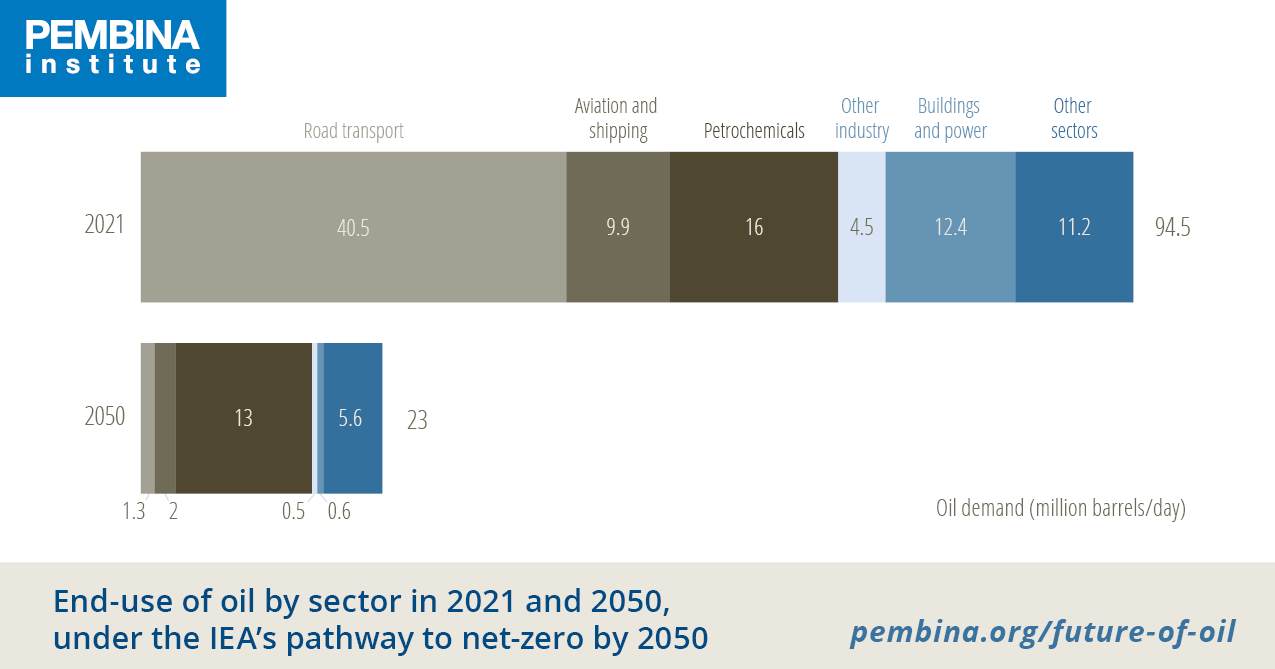

What’s different this time is that the projected fall in demand is not linked to these types of classic boom-and-bust economic cycles. Instead, the scenarios show that big socioeconomic changes are on the horizon that will change the nature of our energy consumption in the long term. We’ll still need energy, but we will increasingly need for it to not have significant carbon emissions associated with it, to accomplish our climate goals. As mentioned, uptake of electric vehicles is one area where carbon-intensive energy is likely to be supplanted by cleaner sources. Oil is currently also used in the petrochemical sector, to make plastics — but the need for new plastics is also likely to decline as governments bring in more bans on single-use items (like straws and plastic bags), or implement recycling policies, to drastically reduce the life-cycle emissions associated with each bit of plastic produced.

Q- What about the war in Ukraine? Don’t countries like Canada need to produce more oil to displace Russian fossil fuels?

This is something we have heard often over the last few months, but it’s more complex than it may appear on the surface. While it is the case that Russia’s invasion of Ukraine has caused some short-term turbulence and disruption to global energy markets, including an increase in demand for oil (and oil prices), this does not necessarily suggest that the world will continue to need increased supplies of oil in the longer term. In particular, the IEA — which published its scenarios more than seven months after the war began — still projects that oil demand is likely to fall this decade.

In fact, the war may have the impact of expediting the global shift away from fossil fuels, as more governments begin to take the view that the supply of domestically-produced sources of energy (such as renewables and other clean energy resources) is more reliable in the long term than importing non-domestic sources of fossil fuels (which are subject to international geopolitical forces, as the last year has shown). The IEA notes, for example, that those regions with more access to renewable energies were more shielded from price spikes in oil and gas in 2022. We’re also seeing signs that some countries that were particularly impacted by the energy supply and price crisis — such as Germany — have accelerated their plans for renewable energy, by increasing subsidies and streamlining regulatory approvals to get projects moving more quickly.

Q- Some proponents of the oil industry have suggested that policies aimed at cutting oil sector emissions is tantamount to forcing the sector to cut levels of production (i.e. that the only way to reduce their emissions in line with the targets is to just produce less oil overall). What do you think of that, in light of these scenarios?

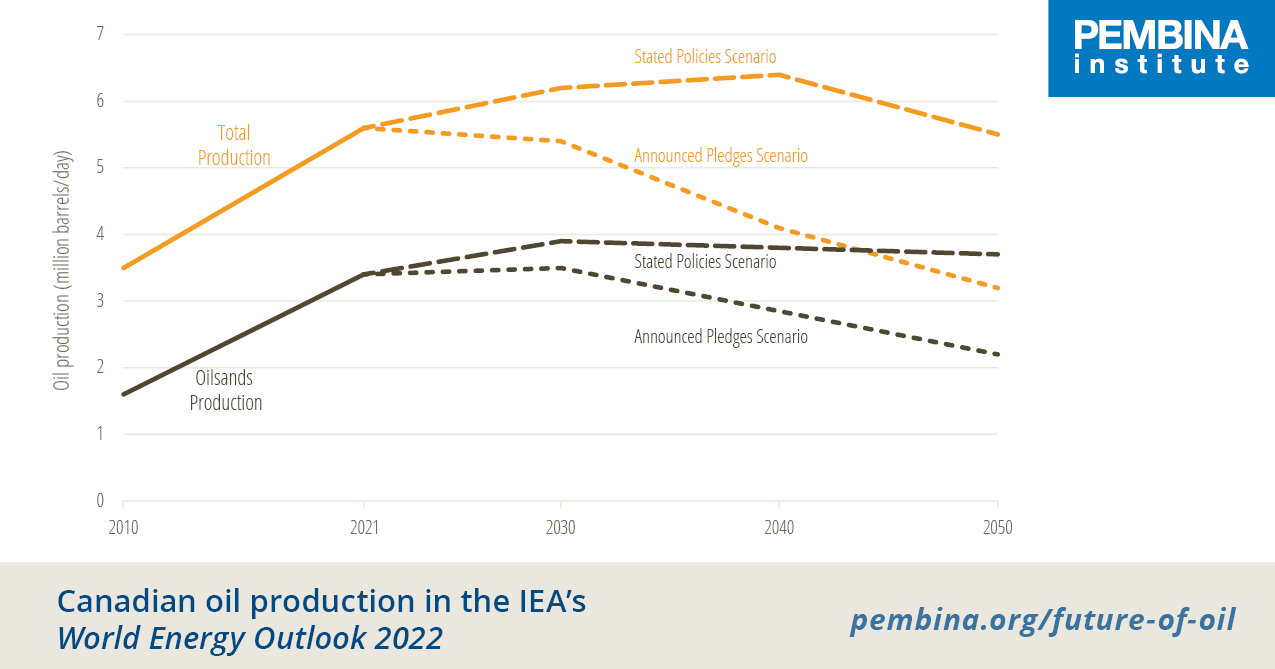

What these scenarios show is that governments aren’t going to need to legislate production cuts – because we will naturally see oil production decrease in line with demand.

However, there’s no suggestion in our report or in these scenarios that global oil demand will dwindle all the way to zero any time soon. So it’s important for the oil industry to recognize that, while there will still be demand for their product in 2050 and beyond, the market is about to get much tighter. In the near future, we think that competition will be based on two things: how much a barrel of oil costs, as well as the level of greenhouse gas emissions that are associated with its production.

In Canada, this is crucial information for the oil industry. Canadian oil remains amongst some of the most carbon intensive in the world — meaning the processes we use to get it out of the ground create more carbon dioxide emissions than oil produced in many other places. In a near future where governments will be under pressure to meet their emissions reduction goals, and therefore scrutinizing the emissions associated with every single supply chain, Canadian oil may quickly find it is not the oil of choice when it comes to carbon intensity. And as demand falls, it can’t afford to lose out to competitors.

That’s why we at Pembina challenge the view put forward by some that a cap on oil and gas emissions will harm the sector. In truth, we think it will help futureproof our oil producers for the next few years — where they’ll need to be both cost and carbon competitive.

Q- What about oil sector workers in Canada?

It’s important to note that jobs numbers in Canada’s (and Alberta’s) oil sector have already declined and then remained pretty flat in recent years — largely because oil companies have automated some processes, implemented cost-cutting measures and entered into mergers with other companies. There have also been fewer megaprojects — which used to see huge influxes of workers into Alberta’s labour market when the oil price was high and companies were investing in new production — being instigated. That trend has remained the same over the last twelve months, despite high oil prices and record levels of free cashflow in the sector.

However, while the IEA’s global net-zero pathway to 2050 modelling estimates a decline in oil, gas and coal employment by 5 million by 2030, it also projects an increase in clean energy employment by 14 million. Net-zero aligned sectors that are poised for market growth and subsequent employment opportunities include renewables; critical minerals; nature-based solutions; CCUS; low-carbon buildings; and low-carbon and zero-emission transportation.

The valuable skillsets and expertise that exist in Canada, and especially Alberta’s workforce in the energy production sectors, are internationally renowned — but we’ll need to transfer to emerging clean energy sectors. For example, we will need engineers to work on production efficiency and other improvements, carbon capture and storage projects in the oilsands, and technicians that can help solve methane leaks from our oil and gas wells. We also need people to design and install wind turbine and solar panels, engineers to work on hydrogen production, and people working on installing clean energy solutions, like electric-powered heat pumps in homes that will replace natural gas furnaces, as well as the design and manufacturing of electric vehicles and charging points.

These oil demand scenarios — along with other net-zero planning scenarios that show the rapid growth of some of these other clean energy industries — should help governments, employers, and unions to make decisions about where to prioritize investments in STEM education, while adding technical and soft skills to Canada’s existing labour force to support the transition to net-zero. The bottom line is, we’ll still need a lot of energy workers, but many of them will be doing different sorts of jobs to the ones they do today in oil production.