This is the second instalment in a series exploring the future of oil in a decarbonizing world, and the implications for Canada’s oil industry. Our first piece, Evaluating the climate ambitions of Canadian oil companies, documents net-zero commitments from Canadian, U.S. and European oil majors.

For the first time in history, there is recognition that global oil demand may stop its unrelenting upward trend sooner rather than later, and instead begin to shrink. Recent energy outlooks suggest that nearly four decades of continued oil demand growth is coming to an end. This slowdown has been exacerbated not only by the global pandemic, but equally by technology changes and global efforts to address the looming climate catastrophe. Canada’s oil industry needs to pay closer attention — and rather quickly at that — if it wants to remain competitive in a quickly changing world.

An imminent drop in global oil demand

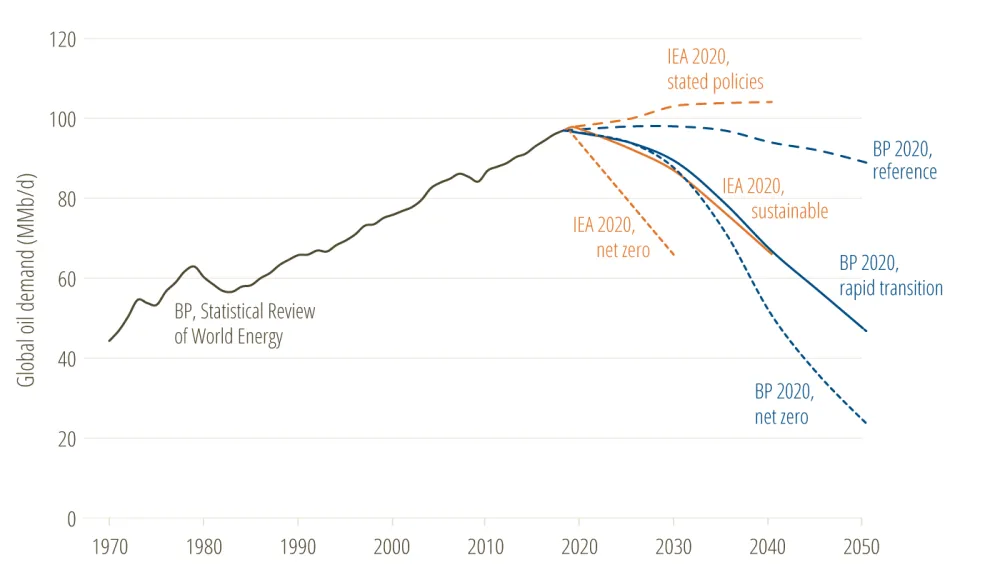

The scenarios illustrated in a number of energy outlooks this year — including those by BP and the International Energy Agency — indicate that global oil demand might plateau in the coming decade for the first time in history (Figure 1). More importantly, a number of scenarios suggest oil demand might have already reached its peak and could experience a steep drop in coming years, in no small part due to co-ordinated action to limit global warming to 1.5ºC and prevent irreversible damage to ecosystems and communities.

Reaching the ceiling

The IEA’s Stated Policies scenario — which models the outcomes under policies currently on the books — should be treated as a ceiling on global oil demand. First, this scenario would result in a 2.7ºC increase in global temperature — not the critical 1.5ºC cutoff needed to limit climate-related risks to human health, livelihoods, food security and water supply as well as economic growth.

In response, regardless of what a pandemic recovery looks like as planes take flight and road trips resume, climate action is expected to continue at an increasing rate. China and Russia have both affirmed commitments to the Paris Agreement, and the Americans will be back in the mix, under recently elected Joe Biden. As a result, even the IEA’s stated policies scenario is increasingly unlikely.

Unequal footing

In fact, the steepness of the decline will depend on how fast leading economies develop and deploy zero-carbon alternatives to fossil fuels to move people and goods around, heat (or cool) their buildings, and run their industries. And regardless of how steep it is, a descent inevitably means that Canadian oil companies will have to compete for shares of a shrinking pie, in a competition where key metrics will be a combination of production costs and carbon emissions intensity.

When it comes to decarbonization potential and technology pathways, all crudes are not equal. In its last World Energy Outlook, the IEA noted that it is already technically possible to reduce oil and gas methane emissions by 75 per cent, and to do so at low costs. Methane mitigation constitutes the low-hanging fruit of decarbonizing oil production, the one everyone will be reaching for quickly in the coming years.

The oilsands, however, which accounted for two thirds of Canada’s oil production in 2019, are associated with relatively lower levels of methane emissions, which are also more challenging to address. This makes those quick and cheap methane mitigation solutions ineffective for the oilsands. Rather, the sector will be forced to deploy its own suite of technologies in order to decarbonize its energy intensive operations.

Reduced oil demand or oil emissions?

Some argue it’s the overall emissions associated with oil — as opposed to oil consumption — that needs to be eliminated. This logic holds true only if both upstream and downstream emissions from refined petroleum products can be fully addressed. While technologies to capture and sequester carbon dioxide or offset emissions exist, they are still very costly to deploy commercially. As the oilsands industry is busy developing solutions to tackle emissions, advancements in electrification are also happening. Emissions reductions technologies in the oil sector will be hard pressed to compete economically with the new generation of zero-emission vehicles. With bans on internal combustion engine vehicles and moves to limit movement of high-polluting vehicles, disruption in the transportation sector is under way.

What this means for Canada

Canada’s oil sector, broadly characterized by higher costs and higher carbon emissions per barrel than most other sources of crude, is not currently well suited to thrive in an era of quickly declining oil demand. The industry is not prepared for scenarios like those modelled by the BP and IEA, where demand falls by 50 to 75 per cent over the next 20 to 30 years.

Adjusting to this new reality of increased decarbonization and decreased demand will require companies to adopt more stringent climate targets — including downstream emissions — as well as to accelerate the diversification of their activities to ensure continued prosperity in a post peak-oil world. In order to protect itself from further divestment while ensuring a tangible contribution to national climate targets, Canada's oil industry needs to adapt quickly to remain relevant and maintain market share. The window of opportunity is rapidly closing.

What does all this mean when it comes to the make-up of Canada’s energy system? The last instalment of this series will consider how domestic energy scenarios can be used to advance Canada’s net-zero objective.