Strengthening B.C.'s carbon tax (as of April 1, 2018) to reduce pollution and help get us back on track to our climate targets is worthy of support. The carbon tax has been an economic and environmental success, and it makes sense to build on this.

Well-designed policy will maintain a strong economy, protect vulnerable Canadians from potentially adverse impacts, and address industry competitiveness concerns. Using revenue to increase the climate action tax credit will ensure low and middle-income families benefit from the transition to a clean economy.

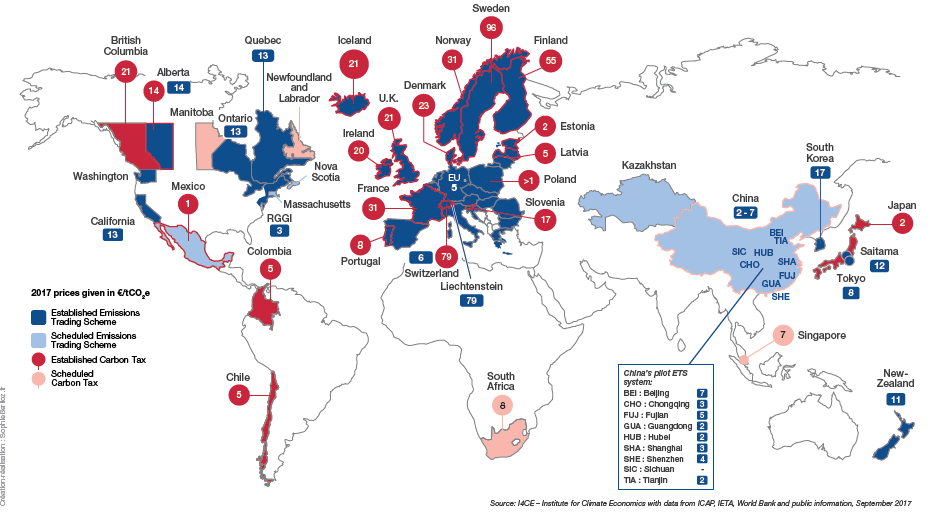

Carbon pollution pricing is one of the tools clean tech entrepreneurs cite as key to supporting clean innovation. Seven of the 10 largest global economies have a price on carbon pollution. By 2018, carbon pollution pricing will be integrated into all provincial and territorial economies. B.C. is gearing up to capture the benefits of clean growth.

Maximilian Kniewasser

Director, B.C. Climate Policy Program, Pembina Institute, Vancouver

The Vancouver Sun published this letter to the editor on page A9 on January 8, 2018.