Canada’s automotive industry faces a long-standing structural vulnerability rooted in its heavy reliance on a single export market: the United States (U.S.). This vulnerability did not emerge from electric vehicle (EV) policies, but rather has defined the industry for decades. With more than 80% of vehicles manufactured in Canada destined for the U.S., the sector is dependent on a single demand source and is therefore deeply exposed to the volatility of U.S. trade policy. This dependency has resulted in significant job losses in the Canadian auto sector due to U.S. efforts to reshore manufacturing jobs and prioritize domestic production. Recent U.S. messaging – including assertions that “we don’t need Canada” and threats of 100% tariffs on all Canadian goods – makes it increasingly clear the U.S. is no longer a secure export market.

Protecting Canadian auto jobs now requires two things working together: building stronger domestic demand and diversifying beyond a single export market. The global shift to EVs offers Canada a rare opportunity to do both — connecting Canadian workers and manufacturers to where the global market is headed, while strengthening the domestic market needed to anchor investment and supply chains at home. If the U.S. market is becoming less reliable, Canada must concentrate on where global demand is expanding.

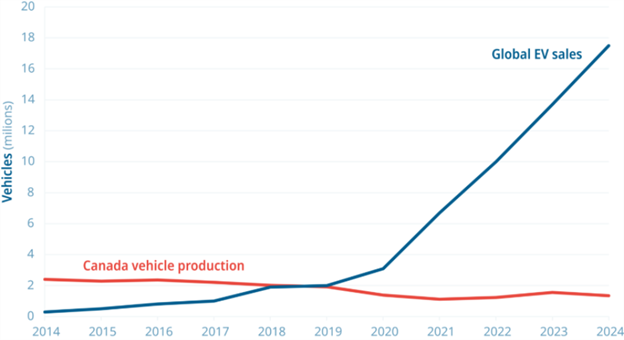

The world is rapidly moving toward EVs, and this transition will continue whether Canada keeps pace.

The fast-growing EV sector presents a major economic opportunity for Canada. However, if we fail to adapt and remain dependent on U.S. demand, we risk being confined to an isolated regional market and undermining our global competitiveness. By diversifying our trading partners and aligning with global investments and supply chain momentum, Canada can expand production, attract new investment and serve domestic demand while reaching growing global markets. This broader market access is essential to stabilizing and growing Canadian auto jobs over the long term.

A diversified, EV-driven sector is the best way to protect Canadian workers and secure long-term industrial competitiveness. This requires building EV demand at home to create a stable foundation that positions Canada as a competitive destination for investment across the entire supply chain. Recently announced partnerships with South Korea and China signal early progress toward this goal.

Canada should build on this by establishing manufacturing partnerships to reinforce its end-to-end EV ecosystem, spanning vehicle assembly, battery production, and the responsible development of critical minerals. EVs are the main driver of new demand for battery materials, making them central to the future of the critical minerals sector. While Canada has an abundance of critical mineral resources, that advantage cannot be fully realized without a strong domestic EV market to pull those materials through the value chain. A growing EV market supports long-term, high-quality jobs and ensures Canada captures more economic value from its mineral wealth.

Policies like the Electric Vehicle Availability Standard (EVAS) and other supportive EV policies that improve affordability and consumer choice (e.g. incentives, charging infrastructure buildout, etc.) are fundamentally about building a strong domestic EV market. This approach encourages companies operating in Canada to offer more affordable models to Canadians, expanding the market and putting downward pressure on prices, and reinforcing the conditions needed to anchor EV manufacturing and employment at home while positioning Canada to compete across a broader set of global markets.