A public online information portal. New rules for collecting financial security from mine operators. Eight new milestones to mark steps in the mine reclamation process.

Those are some of the new measures in Alberta Environment's revamped reclamation program for oilsands and coal mines. The government says the new rules will make the reclamation process more transparent and help protect Alberta taxpayers from financial liability.

But by our assessment, the reclamation program gets a mixed review. While the new program attempts to increase transparency and accountability, the overall foundation of the program is on rocky ground and may put Albertans at even greater risk of paying to clean up the oilsands.

Credit where credit is due

The Alberta government should be congratulated on the improved accountability and transparency with this new policy. There are now consistent reporting requirements for industry and clear rules on audits. The province now requires sign-off by financial officers on any liability estimates and requires these estimates to be audited by accounting professionals. These are all steps in the right direction to get the province exercising its own due diligence in managing liability.

There will also be improved transparency on how reclamation is disclosed and much more nuance to the dialogue on reclamation progress. Previously, land affected by oilsands mining could only be classified as disturbed, reclaimed (as defined by industry) and certified. This new classification will help to elevate and inform future discussions on reclamation performance.

Also noteworthy is the Outstanding Reclamation Deposit required under the new rules. This deposit is meant to act as a financial disincentive for companies who do not reclaim their land on time, as defined in their mine reclamation plan. Certainly providing financial signals to industry that the government is serious about reclamation performance is a welcome step forward.

Also noteworthy is the Outstanding Reclamation Deposit required under the new rules. This deposit is meant to act as a financial disincentive for companies who do not reclaim their land on time, as defined in their mine reclamation plan. Certainly providing financial signals to industry that the government is serious about reclamation performance is a welcome step forward.

However, it is too early to say if the Outstanding Reclamation Deposit will be effective. If the mine reclamation plans are not sufficiently ambitious and do not reflect the government's desire to increase the rate of reclamation, then this type of deposit will provide no financial signal at all to oilsands mine operators.

A step backwards on liability?

While the above improvements are laudable, their importance is overshadowed by a significant shift in the way the province handles oilsands liability management. As a result, the benefits from improved transparency and accountability could be window dressing on a flawed approach.

Under the previous policy, the province collected financial security (in the forms of letters of credit) as the liabilities were accrued. When a liability, such as a tailings lake, was created or was planned for the next year, these liabilities would be reflected by a corresponding increase in the security that was collected. It's important to note that under this system, concerns voiced by the Pembina Institute and the Royal Society of Canada regarding the value and adequacy of the total security fund were paramount. According to Pembina Institute estimates, on-the-ground liabilities could be as much as 24 times higher than the security collected under the old policy. Nevertheless, this fiscally prudent, risk-averse principle underlay the previous mine financial security.

Under the new policy, security is not collected when the liability is accrued; rather, it is collected towards the end of the mine's life. This is managed through an asset-to-liability approach, whereby the value of a mine's undeveloped oilsands represent collateral or an asset to pay for any liabilities should the mine be unable, for some reason, to pay for reclamation. This approach is problematic for a number of reasons:

Overly optimistic assessments

The mining industry has a tendency to be overly optimistic about the size of their assets and, according the December 2010 Royal Society of Canada's report on oilsands, have often "chronically underestimated" reclamation liabilities. As a result this skews any calculations the government uses to assess a mine's ability to pay for cleanup.

Fixed costs

Liability costs are fixed while assets fluctuate in value. While the same liability will exist regardless of the value of oilsands, the price of oil is not known to be stable. The graph below shows the fluctuation in the price of crude oil over the last 40 years. Because oil is traded as a global commodity, and because oilsands represent a fraction (1.4 per cent in 2008) of global oil production, Alberta will be a price-taker of oil and vulnerable to the often unforeseeable price shocks (think Libya, Hurricane Katrina, 2008 global recession) in the oil industry. Meanwhile, the same tailings lakes still have to be reclaimed, regardless of how the energy markets are performing. This commodity risk needs to be accounted for in the new Mine Financial Security Program.

Regulatory risk

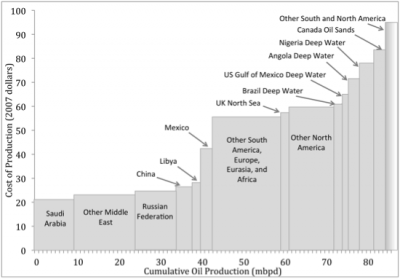

There is also significant regulatory risk when deferring the collection of security for oilsands liabilities. It is no shock that oilsands represent the marginal barrel of oil; the high costs of production (around $80 dollar per barrel in capital and operating costs for some oilsands operations) make it some of the most expensive oil in the world (see chart below). As a result, the oilsands as an industry is risk-exposed; any additional costs from regulations can quickly change the financial viability of a project.

Unfortunately, the federal and provincial governments have not been giving clear regulatory signals to the oilsands industry. The Government of Canada has no clear plan on how they will regulate greenhouse gas emissions from the oilsands or how they will manage threatened caribou populations. Meanwhile, the Alberta government is being inconsistent with its regulation of tailings, and it is unknown how upcoming regional plans, reclamation regulations and wetland policies will affect the bottom line of this price-sensitive industry.

Potential for disaster

Environmental and industrial disasters do happen. The BP Gulf Oil Spill had considerable economic and regulatory ramifications for the entire deepwater offshore oil industry. The Chernobyl and Three Mile Island nuclear accidents have also changed the economic and regulatory playing fields for the nuclear industry - and the crisis unfolding at Japan's Fukushima nuclear facility may have similar implications. In the unlikely, but not impossible, event of a similar tragedy in the oilsands, it is reasonable to conclude there would be a corresponding increase in operational costs, regulatory costs and flight of investment capital.

By not setting aside money when a liability is created, in the event of an environmental or industrial disaster in the oilsands that renders the entire industry uneconomic, the Alberta Government could be left with a very expensive cleanup bill and very little in the bank to cover it.

Basic approach flawed

These four factors demonstrate the flaws in the basic approach to the new Mine Financial Security Program. University of Alberta business professor Andrew Leach states in a recent blog that under the new policy, "we are effectively under-writing the liability on behalf of the project proponent."

The economic costs from collecting security as liabilities are created are slight and the potential to reduce the risks borne by the provincial treasury — and ultimately Alberta taxpayers — is significant.

He adds, "the likelihood that the deferral of letters of credit [a form of financial security] has a meaningful effect on investment is small, so by collecting security commensurate with incurred liability, the risk of a future shortfall is eliminated at little cost." In other words, Professor Leach argues that the economic costs from collecting security as liabilities are created are slight and the potential to reduce the risks borne by the provincial treasury — and ultimately Alberta taxpayers — is significant.

While the Alberta government states that the new policy will triple security, this description is misleading. In reality, in the short to medium term this policy collects less than the previous security program because most of the security will now be collected towards the end of a mine's life. The result is a time span of 20-plus years during which very little reclamation will actually be collected. If any of the factors mentioned above came into play during that time (a span that covers the majority of the mine's operational life), the minimal security collected to that point could leave Albertans facing more risk than under the previous policy.

Why then would the Alberta government opt for such a risk-tolerant policy, while dressing it up with improved accountability and transparency? Not surprisingly, this policy was the result of six years of closed-door negotiations with industry. Over the course of these negotiations, requests from groups like the Pembina Institute to provide input were turned down. As a result, since industry is highly unlikely to offer to pay for liabilities as they happen, the final policy included this deferred-payment approach.

As I have mentioned in a previous blog post, the Royal Society of Canada's report on oilsands stated that, "Responsible government management of [mine liability management] must be demonstrated better than has been demonstrated to date."

Unfortunately, the Alberta government lost an opportunity to shift course and create a reclamation security policy that reduces the risk for Albertans, and to show oilsands companies and investors that the province is serious about managing reclamation liabilities.