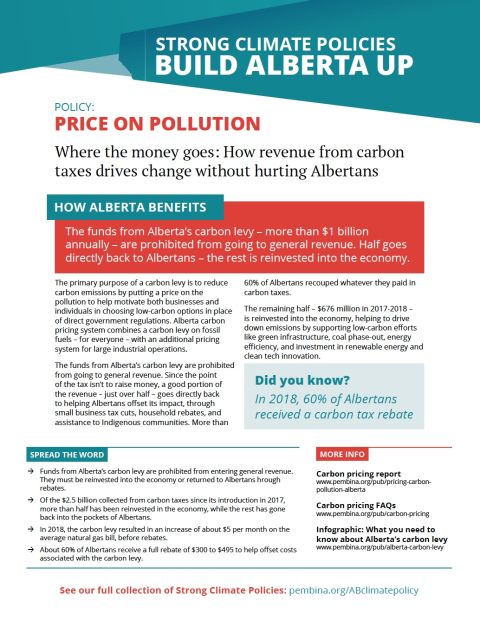

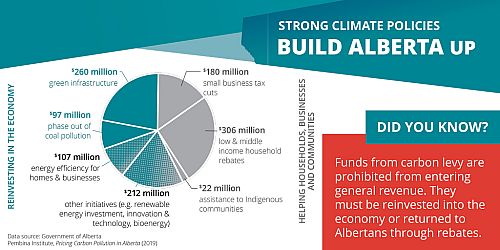

The funds from Alberta’s carbon levy – more than $1 billion annually – are prohibited from going to general revenue. Half goes directly back to Albertans – the rest is reinvested into the economy.

The primary purpose of a carbon levy is to reduce carbon emissions by putting a price on the pollution to help motivate both businesses and individuals in choosing low-carbon options in place of direct government regulations. Alberta carbon pricing system combines a carbon levy on fossil fuels – for everyone – with an additional pricing system for large industrial operations. The funds from Alberta’s carbon levy are prohibited from going to general revenue.

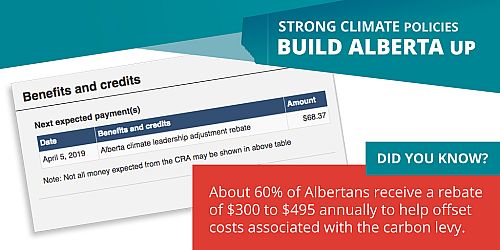

Since the point of the tax isn’t to raise money, a good portion of the revenue – just over half – goes directly back to helping Albertans offset its impact, through small business tax cuts, household rebates, and assistance to Indigenous communities. More than 60% of Albertans recouped whatever they paid in carbon taxes.

The remaining half – $676 million in 2017-2018 – is reinvested into the economy, helping to drive down emissions by supporting low-carbon efforts like green infrastructure, coal phase-out, energy efficiency, and investment in renewable energy and clean tech innovation.

Spread the word

- Funds from Alberta’s carbon levy are prohibited from entering general revenue. They must be reinvested into the economy or returned to Albertans through rebates.

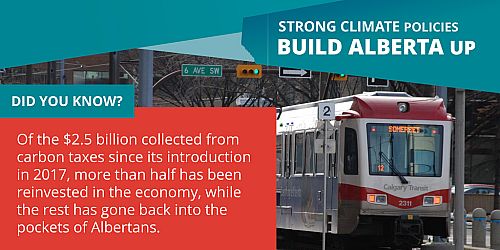

- Of the $2.5 billion collected from carbon taxes since its introduction in 2017, more than half has been reinvested in the economy, while the rest has gone back into the pockets of Albertans.

- In 2018, the carbon levy resulted in an increase of about $5 per month on the average natural gas bill, before rebates.

- About 60% of Albertans receive a full rebate of $300 to $495 to help offset costs associated with the carbon levy.