Insurance premiums are climbing faster than inflation as severe weather losses escalate. Yet, insurers still don’t account for the risk-reduction power of resilient retrofits. Governments and insurers can close this gap by rewarding upgrades that protect homes and lower premiums.

Climate risk has become an affordability issue

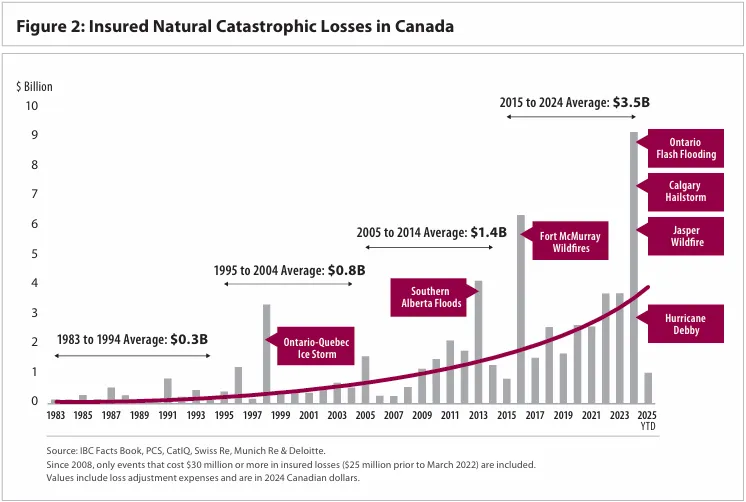

Extreme weather now defines daily life for Canadians. The Insurance Bureau of Canada’s 2025 report demonstrates the financial toll of climate events continues to grow — particularly in Alberta.

Climate change places an impending hazard on the safety of our homes and buildings. An alarming 10% of Canadian households (1.5 million homes) face high flood risk and lack insurance coverage. Over 300,000 people live in high- or very high-risk wildfire zones, including nearly 1 in 5 Indigenous reserves. In 2025 alone, the Canadian Red Cross registered 52,000 wildfire evacuees.

As risks rise, insurance premiums follow. The cost of personal property insurance has outpaced inflation, and in Alberta, home insurance costs have jumped 90 per cent in ten years. Meanwhile, Ontario home insurance rates climbed 84 per cent between 2014 and 2024. This spike erodes affordability for everyone — homeowner’s paying premiums and renters covering this cost indirectly. Severe weather has turned insurance into a front-line affordability challenge.

The insurance system must start valuing retrofit risk reduction

Retrofitted homes can better withstand severe weather, yet insurer’s rarely reward that performance. They continue to price premiums based on exposure, not prevention. When insurers modernize risk models to include verified retrofit measures — like resilient roofing, basement flood protection, and fire-resistant materials — they create a market signal that drives resilience instead of resignation.

Proven frameworks already exist. The climate resilience guides by Natural Resources Canada (NRCan) and Housing, Infrastructure and Communities Canada (HICC) and the U.S. FORTIFIED Home Standard, show how insurers can link physical upgrades to measurable reductions in loss. Recognizing certified retrofit improvements would incentivize homeowners to invest, reduce future claims and stabilize premiums nationwide.

Verification and collaboration can close the gap

Governments and insurers can jointly build the verification systems needed to make this change credible. The National Research Council of Canada (NRC) — in collaboration with NRCan, the Intact Centre on Climate Adaptation (ICCA) and the Institute for Catastrophic Loss Reduction (ICLR) — is developing frameworks that connect certified retrofit measures to quantifiable reductions in climate risk.

When insurers integrate these verified upgrades into underwriting, they can directly reward lower risk with lower premiums. Governments can align incentive and rebate programs with the same standards, ensuring public dollars strengthen affordability and resilience at once. This coordination enhances the business case for retrofit programs and gives building owners a tangible return on prevention.

Resilient retrofits deliver strong returns

Resilient retrofits don’t just protect homes and buildings – they save money. The ICLR estimates that every dollar invested in climate-resilient buildings, yields $11 in avoided damages and insurance savings. Climate Proof Canada, a climate adaptation-focused coalition, recommends that the federal government invest an additional $1 billion by 2030 to help high-risk households retrofit their homes.

Those investments would pay off quickly. Retrofitted homes experience fewer insurance claims and lower recovery costs after a disaster strikes, reducing pressure on insurers and making coverage more affordable for everyone.

From risk to resilience

Climate change is reshaping both the physical and financial foundations of Canadian communities. By valuing resilience, the insurance sector can move from paying losses to preventing them.

Governments, insurers and retrofit providers can act now to align standards, data and incentives. When we reward resilience, we strengthen affordability, protect property value and make our homes and buildings safer and more comfortable. The sooner we start, the more we save.

The Pembina Institute acknowledges the generous support of the Alberta Ecotrust Foundation.