While leadership at all political levels is critical to prevent the most catastrophic impacts of climate change, cities and towns are often the places where the rubber hits the road on climate action. This is particularly true in Canada where little to no effort is coming from the federal government. Several municipalities, on the other hand, are demonstrating real leadership by implementing on-the-ground climate change solutions.

In British Columbia, projects like district energy units, solar hot water systems and energy conservation retrofits are popping up in communities across the province but the real driving force behind such motivated action has remained unclear.

At the Pembina Institute, we like answers, and understanding the economic, environmental and social motivation for these projects has been a priority. Being the policy wonks that we are, we also wanted to know if provincial climate policies — like the carbon tax, the Climate Action Charter and the Climate Action Revenue Incentive Program (CARIP) — were spurring communities to action.

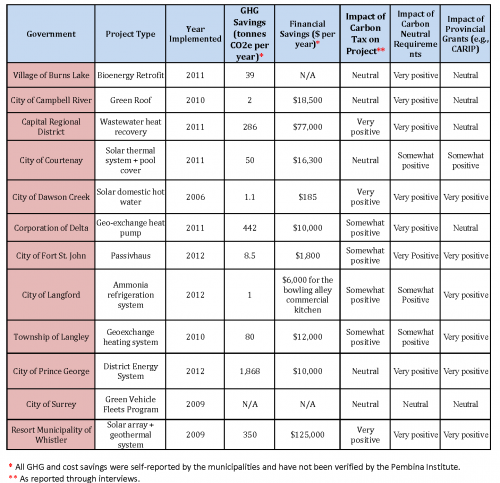

So, we spent some time this summer interviewing local governments in B.C. to learn about their greenhouse gas (GHG) reducing infrastructure projects, selecting 12 from across the province, both small and large. See the bottom of this blog for a chart of all the local governments that we spoke with, including some key project facts and findings.

Motivation

What we found is that the majority of the 12 local governments were motivated simply by a desire to demonstrate leadership by making concrete progress to reduce their corporate GHG emissions. For example, Delta is striving for leadership on climate action in the Lower Mainland, while Dawson Creek and Fort St. John are showing leadership in the north.

“[Carbon neutrality] is a goal that our Council has set for itself. We want to go as far as we can … to be stewards in our community and be part of the overall solution."

— Alan Evans, Capital and Energy Manager, Corporation of Delta.

Many communities identified that the projects demonstrated leadership by making progress on their commitments under the Climate Action Charter, working towards emissions reduction targets and aligning with climate change and sustainability goals in Official Community Plans, sustainability charters or other planning documents.

That said, for many communities, a key motivation was also to alleviate dependence on carbon intensive, and expensive, fossil fuels like natural gas. Demonstrating financial viability of emissions reduction projects was a key factor in getting council approval and community buy-in for projects, especially if it could save taxpayers money in the long run. For example, Whistler and Langley have reduced natural gas consumption from some of their municipal buildings, saving thousands of dollars every year.

Impact of the Carbon Tax

“The tax was an external mechanism that helped us quantify the economic differences between ‘business as usual’ and green infrastructure innovation. While we recognize there are some limitations of the carbon tax, it is a step in the right direction to more holistic accounting."

— Sarah Webb, Climate Action Program Manager, Capital Regional District.Seven out of the twelve communities reported that the carbon tax was “very positive” or “somewhat positive” in building the business case for their projects. By building in the cost of the carbon tax, and even the cost of

future offset purchases (in order to achieve carbon neutrality as required through the Climate Action Charter), some local governments were able to demonstrate that a low-carbon option would not only reduce GHGs and energy costs but also reduce tax and offset payments, improving the overall payback of the project. This was particularly true for some communities, such as the Capital Regional District.

The five remaining communities reported that the carbon tax had a “neutral” impact on the business case, primarily because the rate was not high enough. In other cases, projects were fully funded through external grants, meaning some governments had less stringent requirements to demonstrate a financial payback for the project.

Recommendations

Our results point to the conclusion that provincial government climate policies are helping to drive climate action in the province, though there are four key ways that these policies can be strengthened to improve their effectiveness and reach.

Increase the rate of the carbon tax

“There is no question that the bigger the carbon tax value, the stronger case for the low carbon solution.”

— Ted Battiston, Manager of Special Projects, Resort Municipality of Whistler.

Given the increasing popularity of the renewable energy and energy conservation projects in B.C., a higher carbon tax rate would create an even stronger financial incentive for local governments to consume less energy and switch to cleaner energy sources.

Increase investment of carbon tax revenue in emission reduction projects

“In our community, we direct that money (CARIP) into future energy efficiency projects and to date, it's paid for some really great stuff including enhancing energy efficiency in new boiler equipment that is being installed in our pools, and it’s also going to fund the electric vehicle charging stations that will be installed this year."

— Ryan Schmidt, Community Energy Manager, Township of Langley.

“By weakening how communities can meet the carbon neutral requirement, the provincial government is detracting from the efforts of leading communities who are actually implementing emissions reduction projects.”

— Emanuel Machado, former Director of Corporate Planning and Sustainable Development, City of Dawson Creek. An increased carbon tax rate — or the expansion of the carbon tax to include additional sources — would mean that there is additional revenue available. Some of this additional revenue should be used to support the kinds of emission reduction projects featured in this blog, as well as those supported by thousands of British Columbians as part of the Better Future Fund campaign.

To read more about our thoughts on how to strengthen and improve the carbon tax, read the Pembina Institute’s recommendations for B.C.’s carbon tax review

Encourage municipalities to earmark CARIP revenues toward emissions reduction projects

Signatories of the Climate Action Charter receive a grant that is equal to the carbon tax paid by the local government for energy use in its own operations. To make CARIP an even more effective carbon tax rebate policy, the government of B.C. could encourage, or require, local governments to use the CARIP rebate to fund emissions reduction projects in their communities. Some communities have voluntarily taken this approach, such as Vancouver, Metro Vancouver, Whistler, Dawson Creek and Langley.

Strengthen frameworks for local government climate leadership

We heard from the communities we interviewed that commitments made by local governments — even voluntary ones like the Climate Action Charter — helped them to move forward in implementing the projects we’ve showcased here. Setting and keeping the bar high for these commitments will continue to be an important motivator. We encourage the provincial government to find ways to strengthen and support local leadership through clear frameworks with strong commitments to climate action.

Conclusions

Given that the provincial government is currently in the process of reviewing the carbon tax, the province should note that this policy is driving some local governments in B.C. to invest in low-carbon solutions. By maintaining — and strengthening — existing policies and programs, B.C.’s communities will maintain leadership on climate action in Canada. As Maurice Strong has declared, “the future health of our planet will be determined in our cities.”

A special thanks goes to Timothy Shah, climate action stories intern, for conducting the research and interviews for this project. Please see the research summary for more information.