It was great to hear Prime Minister Stephen Harper — in a year-end interview with the CBC — express openness to the idea of putting a price on carbon emissions. During the interview he cited Alberta’s Specified Gas Emitters Regulation (SGER) as a model that could be applied at a national scale.

Our analysis has found that an Alberta-style model could work at the national level — but it wouldn’t be ideal. From the Pembina Institute’s perspective, the Prime Minister would do well to look further west for the best example.

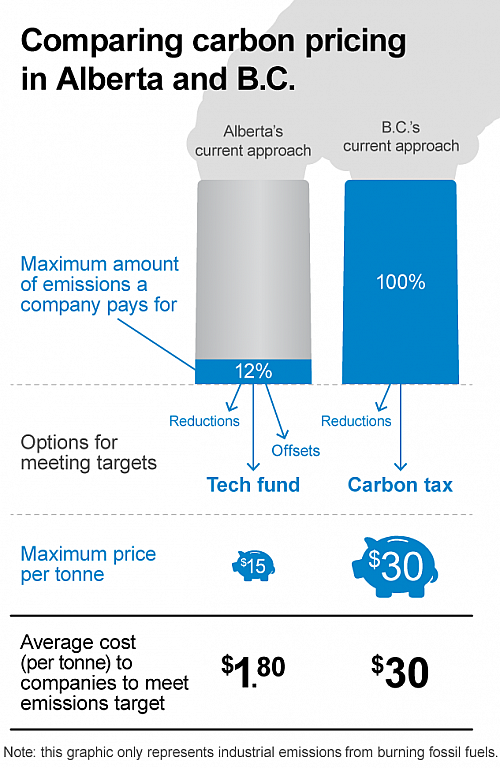

B.C.’s carbon tax applies to most sources of carbon pollution in the province, and has an effective price of $30 per tonne. Since B.C.’s carbon tax was introduced, the province met its 2012 emissions reduction target and per capita fossil fuel use has dropped relative to the rest of the country. And if you’re scoffing at the word “tax”, B.C.’s economy has fared well, outperforming the rest of Canada in terms of per capita GDP.

By comparison, Alberta’s Specified Gas Emitters Regulation (SGER) has not been effective at reducing carbon pollution. The province is not on track to meet its self-imposed targets, even though they are less stringent than Canada’s national target. The SGER has been in effect since 2007 and yet Alberta currently emits more carbon pollution than Ontario and Quebec, home to over 60 per cent of Canada’s population, put together. Progress in other provinces is being cancelled out by rising carbon pollution from Alberta.

It’s evident that the SGER isn’t working.

The regulation only targets very large sources of carbon pollution in the province, requiring those companies to reduce the intensity of their emissions by just 12 per cent. It also gives companies two options that excuse them from actually reducing their emissions: buying offsets or paying $15 per tonne into a technology fund.

When it’s applied to only 12 per cent of emissions, that $15-per-tonne fee actually works out to just $1.80 per tonne on average — and has done almost nothing to slow the growth of carbon pollution, particularly from the oilsands. The price is not set at a high enough level to make reducing emissions economically attractive.

But Alberta can turn its climate record around by strengthening the SGER — increasing the effective price on carbon, while upping the emission intensity reduction requirement — and seizing three other big opportunities to reduce carbon pollution.

So if the Prime Minister is looking for an effective way to put a price on carbon across the country, he should take a closer look at what B.C. has done.

In a speech to delegates at this month’s climate change conference in Lima, Peru, World Bank Group President Jim Yong Kim said, “The example of British Columbia is one of the most powerful. Its carbon price mechanism is neutral to the tax payer — it’s not an increase in tax.”

Putting a price on carbon nationally would demonstrate climate leadership, yet Canada wouldn’t find itself alone. Since B.C.’s tax was introduced 15 new carbon-pricing policies have been implemented around the world, in places including France, Japan and California. More are promised for 2015 and 2016.

While Alberta’s carbon pricing system can be improved, B.C.’s experience already provides a worthy, reliable and affordable example the rest of the country could follow.