News broke this week that Alberta is considering strengthening greenhouse gas regulations on the province’s energy industry. The so-called “40/40” plan proposed by the Environment Minister Diana McQueen would increase Alberta’s intensity-based emissions target and its carbon price. The very mention of such a move has kicked off a long-overdue conversation about what it’s going to take to curtail greenhouse gas pollution and develop Alberta’s resources responsibly.

First things first: the Minister and her government deserve credit for acknowledging that Alberta’s regulations need to be strengthened and starting the work of improving the province’s carbon pricing system.

Pembina has long believed that better environmental performance — especially reducing greenhouse gas pollution — is necessary to enable Canada’s oil and gas sector to compete globally and earn social license. That message has become crystal clear thanks to policies in the EU and in California promoting lower-carbon fuels, and to the climate change concerns raised by opponents of the Keystone XL pipeline proposal.

It looks like the Government of Alberta is reading the writing on the wall and is now considering what kind of policies they need to adopt in response. This is encouraging, and it shows leadership.

But we’re also happy to hear, as the minister said in a statement this week, that “these discussions are ongoing.” Because while the approach we’re reading about in the newspapers is a good starting point, the “40/40” proposal on its own doesn’t get us on track to meeting Canada’s emissions targets.

40/40 in context

It’s important to remember that Alberta’s oilsands represent the fastest growing source of greenhouse gas pollution in Canada, and as a result is the biggest barrier to meeting our international climate obligations under the Copenhagen Accord. So how Alberta regulates the oilsands producers operating within its borders is critically important to Canada’s overall efforts to curb emissions.

It’s important to remember that Alberta’s oilsands represent the fastest growing source of greenhouse gas pollution in Canada, and as a result is the biggest barrier to meeting our international climate obligations under the Copenhagen Accord. So how Alberta regulates the oilsands producers operating within its borders is critically important to Canada’s overall efforts to curb emissions.

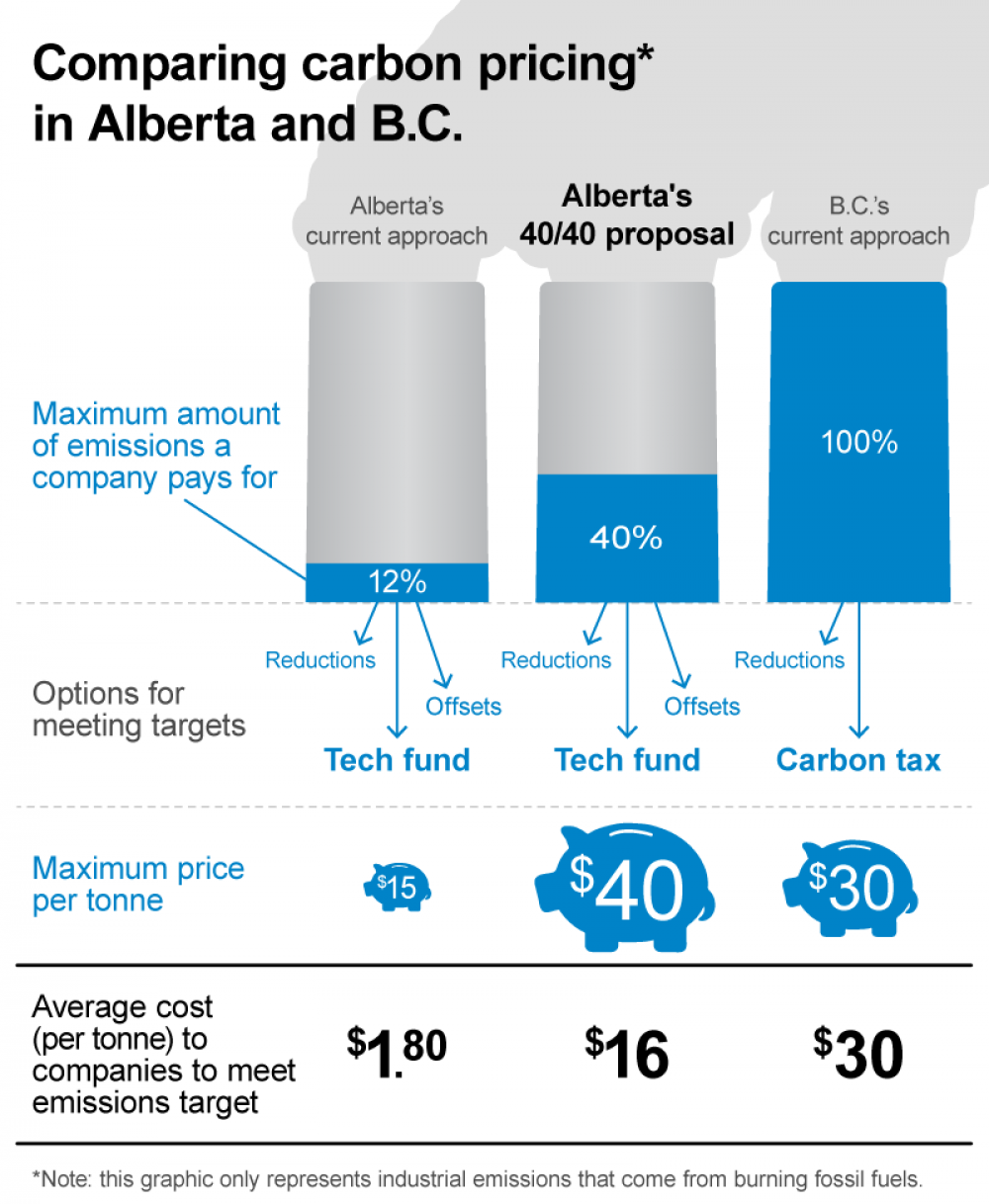

Right now, industries in Alberta — oil and gas, but also coal and other large industrial operations — have a target of improving their “emissions intensity” (emissions per unit of production, such as per barrel of oil) by 12 per cent relative to the baseline, or typical emissions performance, for specific facilities. If they can’t meet that target by improving performance in their operations, they can pay into a technology fund instead, at a rate of $15 a tonne.

The “40/40” approach would increase the target to 40 per cent and raise the technology fund price to $40 a tonne. In both cases, that would represent a noteworthy jump from the status quo.

Most of the climate policy scenarios used in Canada and around the world assume that policies start relatively slowly and steadily increase in stringency over time. If the new Alberta proposal is as described, it doesn’t include this steady improvement over time. As a result, the one-time increase to Alberta’s policy would fall short of getting Canada on track to hit its 2020 climate target. In a report we released earlier this week looking at greenhouse gas regulations for the oil and gas sector in Canada, we recommended strengthening Alberta’s model so that it delivers:

- A 42 per cent intensity improvement from the oil and gas sector

- A technology fund price of at least $100 a tonne by 2020, with $150 a tonne offering a better shot at hitting Canada’s target, and

- A limit on companies’ access to offset credits.

Alberta’s 40 per cent target is in the range we recommended, but its technology fund price – if left unchanged between now and 2020 – falls well short of what’s needed to get us on track to Canada’s 2020 target that we agreed to in Copenhagen.

From 40/40 to 2020

So here’s an idea for Alberta’s cabinet to consider as it debates Minister McQueen’s proposal: why not start with 40/40, but add $10 a tonne every year after that? Assuming the policy goes into effect in 2014, that would get Alberta to the $100 per tonne technology fund price we need to have a chance of hitting Canada’s target in 2020. Call it the “40/40 Plus 10” package.

Because many emissions improvements in the oilsands will cost $100 a tonne or more, companies need a strong and predictable price signal to convince them to invest in technology to improve their emissions performance.

Alberta’s current greenhouse gas regulation has been critiqued for being a static policy — its stringency has not changed since the regulation took effect in 2007. (In contrast, B.C.’s carbon tax started at $10 per tonne and increased by $5 each year until it reached $30 per tonne last year after the last scheduled increase.)

A predictable schedule that ratchets up the policy’s effectiveness over time gives industry more certainty while achieving the triple-digit carbon price level that Canada will need to reach its climate goals. It also avoids hitting companies with sudden price shocks so that they have time to prepare for investments while prices are still relatively low.

What would 40/40 mean to industry?

Alberta hasn’t yet announced the details of this proposal, and details matter. You might think that Alberta’s proposal would mean a somewhat stronger incentive to cut emissions (“marginal cost”) than B.C.’s current carbon tax, which is set at $30 a tonne.

It isn’t an apples-to-apples comparison because the approaches are fairly different — take a look at the graphic below. Under Alberta’s proposal, the large emitters that it applies to would pay up to $40 per tonne for up to 40 per cent of their emissions (compared to 100 per cent in B.C.’s case). That means that the cost of Alberta’s proposal averaged across 100 per cent of a facility’s emissions would be up to $16 a tonne (40 per cent of $40).

Still struggling to make sense of it all? Check out our blog: "How carbon pricing currently works in Alberta"

A 40/40 average cost per tonne works out to just under $1.50 a barrel of bitumen for a typical in situ oilsands facility. Once you account for the interaction with royalty rates and taxes, the company would see an effective cost of under 75 cents per barrel. (For comparison, the effective cost of Alberta’s current system works out to less than 10 cents a barrel, and the system we recommended in our oil and gas report this week would mean an effective cost of less than $3 a barrel.)For a typical oilsands project, complying with the government’s 40/40 proposal is likely to cost less than 75 cents per barrel of bitumen produced

Some of the companies operating in Alberta also have facilities in B.C., so they’ve learned to compete under that province’s carbon tax. Many energy companies already consider far higher carbon prices in deciding whether or not a project proposal makes economic sense. So despite the inevitable grumbling from some industry players, the prices we’re talking about here are completely manageable.

In fact, far from harming Alberta’s industries, effective climate regulations would be good news for the future of the province’s energy sector, which is struggling to gain market access precisely because it is environmentally uncompetitive.

As everyone knows, Alberta’s oilsands are under scrutiny at home and abroad. Right now, neither Alberta nor Canada has a good enough environmental track record to reassure the sector’s critics or decision makers in other jurisdictions. Strong regulations would help the sector gain the public support it needs to operate, spur innovation and give companies certainty as they make investments that can last for decades.

Alberta’s government has a lot to consider as it finalizes a stronger regulatory proposal on carbon emissions — and it needs to move swiftly to put some meat on the bones of this proposal. Let’s hope it builds on the minister’s 40/40 plan as a starting point to craft the effective climate regulations that Alberta and Canada urgently need.