It’s not often we see international praise for climate change policy in Canada, but that’s exactly what the Organization for Economic Cooperation and Development (OECD) did in a recent report, highlighting British Columbia’s carbon tax as a leading example of carbon pricing.

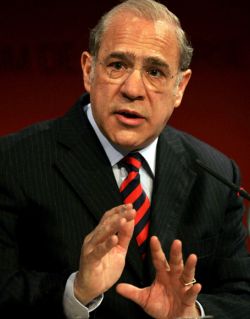

Secretary-General, Angel Gurría, further stressed the point in an accompanying speech, espousing B.C.’s carbon tax as being “as close to a textbook example as we have.” For a country that has such a bad track record internationally when it comes to climate change, this might seem like a surprising statement. But evidence from B.C.’s experience with the carbon tax is indeed positive

As seen in B.C.

The carbon tax was quick and relatively simple to set up, going from announcement to implementation in just five months. Compare this to the many years that Canada’s regulatory process is taking to establish sector-by-sector performance standards that, so far, are entirely inadequate. Canada’s coal-fired power regulations, for example, took more than two years to get from announcement to final regulation. They don’t take effect until mid-2015 and are expected to contribute very little to meeting Canada’s emissions commitments.

“In our view, any policy response to climate change by any country must have at its core a plan to steadily make carbon emissions more expensive while, at the same time, judiciously giving non-fossil energy and energy efficiency an advantage at the margin. This is fundamental. …without placing a clear and explicit price on emissions we are, as they say, just ‘pushing at a piece of string’ when it comes to changing consumer, producer and investor behaviour.”

“In our view, any policy response to climate change by any country must have at its core a plan to steadily make carbon emissions more expensive while, at the same time, judiciously giving non-fossil energy and energy efficiency an advantage at the margin. This is fundamental. …without placing a clear and explicit price on emissions we are, as they say, just ‘pushing at a piece of string’ when it comes to changing consumer, producer and investor behaviour.”

— OECD Secretary-General Angel Gurría

Early evidence suggests that B.C.’s carbon tax has been effective in curbing emissions. The tax covers roughly three-quarters of B.C.’s carbon pollution, and these emissions have been declining on a per-capita basis, especially relative to trends in the rest of the country. We can’t say this is entirely due to the carbon tax, but it is an important part of the package of climate policies in B.C. that are contributing to these trends. A more detailed econometric study that isolated the carbon tax’s impact on gasoline demand attributed a significant drop in that demand to the carbon tax.

Importantly, B.C.’s economy has fared well since the carbon tax was implemented, performing slightly better than Canada’s based on per capita gross domestic product. In short, the carbon tax has been an economic and environmental success story based on the evidence to date.

None of this is to say that B.C. has answered all of its climate and energy related challenges. The province is central to Canada’s debate over oil pipelines, and the potential for significant liquefied natural gas exports from the province could undermine much of its hard-earned success on the climate file. But, what is clear is that B.C.’s carbon tax provides a solid foundation for the province to build upon — and for other governments to replicate.

Going national

Just imagine if the rest of Canada followed B.C.’s example.

Overnight, there would be a $15 billion incentive to reduce greenhouse gas emissions across the Canadian economy. So whether it is weighing the pros and cons or carpooling once a week, or making a billion-dollar investment to phase out coal power, Canadians and Canadian businesses would have a concrete economic reason to consider the environment when they make decisions.

There would also be $15 billion of new revenue for governments to invest in the country each year. That could go to new clean energy programs, deficit reduction, climate change adaptation, or reducing other taxes as B.C. does. Money is hard for governments to come by, so any environmental policy that allows for additional fiscal flexibility has a significant upside compared to other policies that do not.

But, to even begin having a conversation about carbon taxes, politicians (federal ones, especially) will have to get over their aversion of carbon taxes. As Sustainable Prosperity’s researchers delicately put it:

“The actual experience with carbon taxation in British Columbia—its environmental, economic and political impacts—appears to be directly opposite to the perceived reality in the federal political debate on this issue.”

In recent years, the federal Conservatives have gone out of their way to vilify carbon taxes at every opportunity. And through these attacks the rhetoric has become completely unhinged from reality on the ground in B.C. and in other jurisdictions that have implemented similar policies.

If politicians were to heed the OECD’s advice, examine the experience of jurisdictions using carbon pricing and have an honest conversation about what we need to do as a country to address climate change, there's no reason that a renewed consideration of a national approach to carbon pricing shouldn’t be possible. Having a “textbook example” of a carbon tax right here in Canada should make the conversation that much easier.

P.J. Partington was a senior analyst with the Pembina Institute's federal policy group until 2015.