Earlier this week, five CP Rail tank cars jumped the tracks just outside of Jansen, Saskatchewan, spilling more than 91,000 litres of crude oil. Last month, a similar derailment near White River, Ontario, resulted in a 63,000-litre oil spill.

While these trains were not carrying bitumen from the oilsands, it’s becoming increasingly common to move oilsands by rail, particularly as public opposition to various new pipeline proposals continues to grow and oilsands producers seek other shipping options.

Add to that a capacity crunch caused by booming oilsands production, double-digit growth rates from Alberta’s conventional oil sector, and surging U.S. shale oil production — suddenly, shipping bitumen by rail is looking increasingly attractive for an industry that is getting progressively more worried about moving its product to market.

But it raises other worries, with some observers suggesting the successful opposition of pipeline proposals may inadvertently be creating more environmental risks as a desperate industry looks to other means of shipping bitumen, including moving bitumen by rail.

Oil-by-rail gaining popularity

While a number of oilsands companies — including Southern Pacific, Cenovus and Connacher — are already shipping oilsands by rail, or have plans to do so in 2013, the competition for pipeline capacity is forcing oilsands producers to slow development plans and is creating demand for a slew of alternative shipping proposals.

Among the new proposals is a First Nations-led initiative, G7G, which is proposing an electric rail link between Alberta’s oilsands and the under-utilized TransAlaska Pipeline that could transport up to 4 million barrels per day of oil. The idea of exporting oilsands crude by rail via Churchill, Manitoba on Hudson’s Bay has also been floated by the Churchill Gateway Development Corp. and has captured the attention of the Government of Alberta.

Canadian National (CN) and Canadian Pacific (CP), two major Canadian rail companies with extensive transcontinental rail networks, have been actively pitching rail as another method to ship bitumen and have seen increasing shipments of oil over the last few years. In 2011 CN moved around 5,000 rail cars of crude oil, while CP moved 13,000 rail cars. In 2012, that number increased six fold for CN to 30,000 and four fold for CP to 53,500. While this increase is notable, CN and CP’s shipments together only amount to nearly 137,000 barrels of oil per day — around four percent of Western Canada’s oil supply.

Pipeline and rail advocates face off

Not surprisingly, the pipeline industry has responded to this decline in its market share with statistics and research showing that rail is not a viable option.  TransCanada President Alex Pourbaix has noted that transporting oil by rail creates three times more climate pollution and is 10 times more likely to have a incident, leak or spill. Meanwhile Canadian National Railway Co. has argued the opposite, with statistics showing that rail emits over two times less greenhouse gases than crude oil pipelines, and spills less crude oil by volume.

TransCanada President Alex Pourbaix has noted that transporting oil by rail creates three times more climate pollution and is 10 times more likely to have a incident, leak or spill. Meanwhile Canadian National Railway Co. has argued the opposite, with statistics showing that rail emits over two times less greenhouse gases than crude oil pipelines, and spills less crude oil by volume.

The U.S. State Department looked at rail in its analysis of the proposed Keystone XL pipeline and concluded it was a viable, albeit more costly, alternative to pipelines. Estimates of the cost of shipping oilsands to the U.S. Gulf Coast by rail range from $15.50 to $31 per barrel, compared to around $7 per barrel by pipeline. The additional cost of rail offers greater diversity of marketing options, allowing producers to sell more flexibly to the highest bidders at any given time.

Both approaches carry environmental risks

The environmental costs and advantages of each option are more challenging to compare. On climate change, as noted above, there have been opposing conclusions reached depending upon the assumptions of the study. For instance, the electrical grid, which powers pumping stations for pipelines, can vary greatly — Alberta’s coal-heavy power grid is 30 times more carbon-intensive than British Columbia’s hydro-powered grid, and this could affect climate-related impact assessments. In our analysis of Enbridge’s Northern Gateway pipeline application, we discovered that Enbridge had completely omitted emissions from their pumping stations. And factoring in the exact contents of the railcars, including whether you need diluent at all, significantly changes the carbon intensity of rail transport relative to pipelines, which must ship diluted bitumen.

Spill frequencies tend to be higher for rail compared to pipelines (estimates range from 3 to 33 times higher) but the volume released during those spills tends to be smaller because rail spills are arguably much easier to detect and are limited in scale, with rail cars carrying 500-600 barrels of oil per car. This limits the size of a spill in the case of a derailment, while the relatively higher number of along-the-track employees for rail companies make it very difficult for an incident to remain undetected.

Spill frequencies tend to be higher for rail compared to pipelines (estimates range from 3 to 33 times higher) but the volume released during those spills tends to be smaller because rail spills are arguably much easier to detect and are limited in scale, with rail cars carrying 500-600 barrels of oil per car. This limits the size of a spill in the case of a derailment, while the relatively higher number of along-the-track employees for rail companies make it very difficult for an incident to remain undetected.

The location where a spill occurs is a determining factor of how serious it may be. Many Canadians can still remember the 2005 CN accident where nearly 800,000 litres of oil products spilled, with 196,000 litres contaminating Wabamun Lake west of Edmonton. In a report on this accident, Canada’s Transportation Safety Board found that “the lack of an emergency operations centre … resulted in poor organization and communication, as well as poorly defined roles, responsibilities, and a lack of overall effective joint planning and coordination with emergency responders and government agencies.”

Had those rail cars been carrying bitumen from the oilsands, the cleanup could have been significantly more difficult and costly, as the Marshall, Michigan pipeline spill in the summer of 2010 demonstrated. It took Enbridge 17 hours to detect and to stop a 20,000-barrel oilsands spill. The spill contaminated a branch of the Kalamazoo River, causing significant harm to the aquatic ecosystem and costing nearly $1 billion to date for the cleanup, which is ongoing.

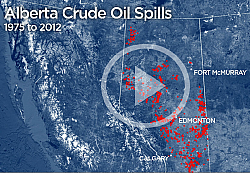

It’s sobering to consider that, according to the U.S. Pipeline and Hazardous Materials Safety Administration, existing systems have only detected five per cent of pipeline spills in the U.S. over the past decade. And data from Alberta’s energy regulator indicates the province’s pipelines have seen an average of two oil spills every day for the past 37 years — excluding export or interprovincial pipelines that fall under federal jurisdiction.

Independent research is critically needed

The public lacks the information needed to judge the relative merits of rail and pipelines — partly due to a lack of credible and independent quantitative analysis on the differences.

For starters, reliable and independent data on greenhouse gas and air emissions for both options are needed. This would include consideration of the implications for lifecycle emissions of oilsands relative to other crude imports into the United States.

A second critical component would be clarity on how increased shipments of bitumen by rail would impact our ability to meet Canada’s climate targets, by enabling growth of oil sands. From the Pembina Institute’s perspective, any new methods of oilsands transport will be problematic — since all will facilitate oilsands expansion — as long as there remain critical unresolved gaps with how Alberta and Ottawa are managing the climate and regional environmental impacts of oilsands development. (Two years ago, we outlined 19 steps that would put Alberta on track toward responsible resource development, but the provincial government has made substantial progress on just two of those policy solutions.)

A second critical component would be clarity on how increased shipments of bitumen by rail would impact our ability to meet Canada’s climate targets, by enabling growth of oil sands. From the Pembina Institute’s perspective, any new methods of oilsands transport will be problematic — since all will facilitate oilsands expansion — as long as there remain critical unresolved gaps with how Alberta and Ottawa are managing the climate and regional environmental impacts of oilsands development. (Two years ago, we outlined 19 steps that would put Alberta on track toward responsible resource development, but the provincial government has made substantial progress on just two of those policy solutions.)

Then comes the question of whether rail companies can ship bitumen safely. Will there need to be upgrades to tracks or tank cars? How prepared is the rail industry for a bitumen spill? Research from Greenpeace has unearthed ongoing concerns by Canadian and U.S. regulators over the safety record of the type of tank car that is predominantly used to ship oil by rail. What have oilsands-by-rail proponents done to address the concerns around these problematic tank cars?

Earning public trust starts with acknowledging risks

For a long time, rail has been viewed positively by the environmental groups concerned about rising greenhouse gas emissions from personal vehicles and transport trucks. To what extent are rail companies — and their investors — ready for the intense scrutiny associated with transporting bitumen? Pipeline companies are already facing increasing pressure from the public and regulators following high-profile oilsands spills in Michigan and Arkansas.

The rail industry should not expect a free ride: in a letter to the Canadian National CEO this past January, 16 environmental groups raised a number of safety and environmental concerns related to shipping bitumen by rail; such concerns will need to be addressed in order to earn social licence. For rail companies to succeed where pipeline companies have failed, they must publicly identify and demonstrably address the unique risks posed by transporting bitumen.

If we set aside issues about how oilsands development is managed, it’s clear further questions need to be answered to assure Canadians and Americans that rail is an appropriate option for moving oilsands.

In this integrated business and social environment, the story of shipping bitumen by rail is linked to the oil tankers on B.C.’s North Coast, the refineries of Port Arthur, Texas, the oilsands mines of Northern Alberta, and the ability for Canada to take meaningful action on climate change. Unless the oilsands industry connects the dots both upstream and down, rail’s time of reckoning may be just around the bend.

Nathan Lemphers was a senior policy analyst in the Pembina Institute's oilsands program, until 2013.