Are Canada’s provinces and territories up for the challenge of meeting their climate change objectives while increasing innovation and growing their collective GDP by four per cent?

Yes, you read that correctly — a safer climate, more innovation and a stronger economy.

That, in essence, is the challenge laid down by the Ecofiscal Commission in their carbon pricing report released yesterday. The Commission looked at what it would take for each of the provinces and territories to achieve their own climate change commitments, and how doing so would affect provincial economic growth. Their analysis compares one scenario, in which the targets were met with regulations, with three scenarios in which carbon pricing was the main driver of change. Let’s take a look at how those three scenarios play out.

What the Ecofiscal Commission found

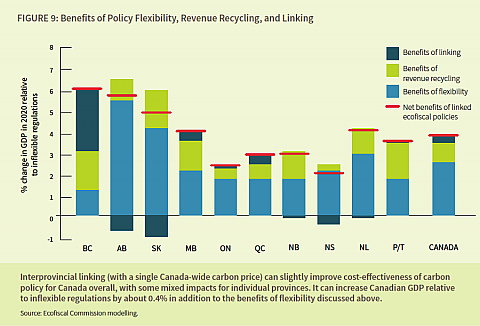

The following chart does a nice job summarizing their results. The bars show the province-by-province benefit of using carbon pricing relative to regulations. The column on the far right reflects the overall national benefits, indicating that Canada’s GDP could be almost four per cent larger with carbon pricing than it would be under a less flexible regulatory approach.

To break it down further, the various coloured bars show how the overall benefit is achieved. On a national basis, the lion’s share of GDP benefit (the 2.5 per cent shown in light blue) comes from the simple step of putting a price on carbon. Next is the 0.9 per cent (in yellow) that comes from using carbon pricing revenue to reduce personal income taxes. Finally, the last slice (0.4 per cent in dark blue) comes from linking and coordinating provincial carbon pricing systems.

It’s not surprising to see carbon pricing paying off more than the federal government’s preferred “sector-by-sector” regulatory approach. According to the Commission, an ecofiscal policy such as pricing carbon “corrects market price signals to encourage the economic activities we do want (job creation, investment, and innovation) while reducing those we don’t want (greenhouse gas emissions and the pollution of our land, air, and water).” Economists have long argued that pricing carbon is more transparent, flexible and efficient than regulating carbon emission reductions.

What is surprising, however, is the extent to which the provinces stand to benefit from pricing carbon emissions within their own jurisdiction, and without waiting to coordinate those efforts nationally.

Provincial leadership pays off

The Commission found that the provinces could independently achieve almost 90 per cent of the potential economic benefits — even without interprovincially coordinated carbon pricing systems. Accordingly, their recommendations focus on the provinces. That’s not an excuse to not pursue the last 10 per cent of benefits, but it makes a compelling case for individual provinces to move forward immediately and go after the last 10 per cent together over time.

It’s hard to predict how easy (or hard) that last 10 per cent would be to achieve. Coordination could become more difficult once a variety of provincial approaches become entrenched over time. Or it’s possible that coordination would become easier because the approaches naturally begin to converge over time. A federal government that shows more support for carbon pricing would also certainly help the prospects for coordination.

But this report wisely focuses on the 90 per cent of benefits within reach today. The opportunity to pursue climate solutions that boost innovation and strengthen the economy applies to all provinces — whether they’re on track to meet their targets or not, and whether they’re already pricing carbon or not. As the figure above shows, every province benefits economically from carbon pricing. And those benefits are significant.

Take Alberta as an example, where the GDP benefit from carbon pricing relative to a regulatory approach could be almost six per cent. Assuming that Alberta’s government revenue stays at about 13 per cent of provincial GDP, the increase in GDP would increase revenues by about $1.5 billion annually — nothing to be scoffed at in a province projecting a $5 billion deficit in 2015-16.

Next steps for the provinces: keep going, or get going

For the provinces without any carbon pricing system in place, the message is clear: get going. The B.C. carbon tax and Quebec cap-and-trade system offer good designs that can speed up the implementation process. Ontario looks set to be next off the mark, with the details of a cap-and-trade system anticipated this spring. With that move from Ontario, provinces representing 86 per cent of Canada’s population would have carbon-pricing systems in place.

For the provinces that already have well-designed carbon pricing systems (B.C. and Quebec), the message is simple as well: keep going. They both have more work to do to meet their targets, so why not pursue that goal with an approach that maximizes economic benefits and innovation? B.C. provides a perfect illustration — the province has an aggressive target, some good initial policy successes (including its carbon tax), and lots of work left to do if it is going to meet its target. The province also has the most to gain economically from carbon pricing, and could see a benefit of more than six per cent improvement in its GDP if it accelerates its efforts and coordinates them with other provinces.

For the province with a weak system in place (Alberta), the challenge may be the most complicated. Just like the rest of the country, Alberta needs to do more and would reap substantial rewards from prioritizing carbon pricing in its approach. How it goes about doing so where things get more complicated: Alberta could strengthen its carbon pricing system, which isn’t achieving much in its current form but has potential for improvement if the existing rules became more stringent. Or, Alberta could simplify things and get better results by switching to an approach like B.C.’s carbon tax.

From my perspective, the Ecofiscal Commission’s analysis is a constructive contribution to the climate conversation in Canada and one that helps to communicate the benefits of getting moving on carbon pricing. Hopefully that thinking influences the conversation at the Premiers’ climate summit in Quebec City next week and the ongoing lead-up to the international climate negotiations in Paris later this year.

Matt Horne was the Pembina Institute's associate regional director for British Columbia until 2016.