Greg Schnell is my brother-in-law as well as a technical stock analyst. He spends his time poring over stock charts, deciphering meaning from their erratic meanderings.

On one of my many trips to Calgary for Green Energy Futures, we were solving the problems of the world over a bottle of wine when out of the blue Schnell started sharing some research he had done on solar stocks.

I don’t really follow the stock market, but Schnell, who’s also a writer with Stockcharts.com, knew I’d be interested in his findings.

“We can see how things behaved in history and we can use that to look at how the same cycle might happen in this new business. We see solar as a new secular bull market. It will have ups and downs but in general the trend will be long and big,” says Schnell.

That’s technical analyst speak for "solar companies are going to do well."

“I think solar has a good 15 year run ahead of it as part of a major thrust into the mainstream of the market.” says Schnell.

And while Schnell is a good-hearted guy, he is not some wishful greenie hoping for a solar revolution. His prediction is based on his hard-nosed assessment of the stock charts.

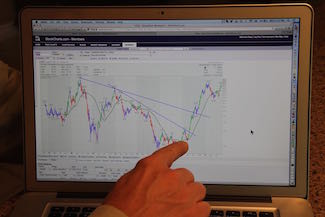

To help me understand he loaded up the charts for companies he identified as industry leaders: First Solar, Canadian Solar and Solar City. He then walked me through what happened to Microsoft in its long climb up the stock charts and compared it to what he sees across the solar sector. You can see his explanation in this short video.

We have done stories on the rise of solar before but these were based on growth in installations in Germany, Bloomberg predictions and the amazing reductions in the pricing of solar. This is something else entirely — the cold, hard, impersonal hand of the market is now making the case for the rise of solar.

Four reasons solar is taking off

Schnell says solar has four main benefits that support his prediction.

- The performance of solar PV modules is constantly improving.

- Solar is already cost competitive with coal and nuclear. A recent Deutsche Bank study found that solar will soon be as cheap or cheaper than average electricity bill prices in 47 U.S. states.

- It benefits from having no real enemies. Putting solar on rooftops doesn’t come with the NIMBY issues that big wind and thermal power plants do.

- And solar can be easily adapted to its location. With rooftop solar the grid connection and customers are already there, and you don’t have to pay for land or transmission lines.

And this is playing out on the ground in the U.S. right now. The U.S. installed 220 megawatts of solar on rooftops in the first quarter of 2014 alone. In Q2 the U.S. installed 1,133 megawatts of solar PV — that's 53 per cent of all electricity generation installed in the U.S. in the first half of 2014.

Not a stock pick

Let’s be clear, this story is not a recommendation to buy any particular stock, this is a story about how the solar sector is starting a potentially long bull run.

We talked to Stephen Lacey, a senior editor at Greentech Media in Washington, D.C., to get more context. He’s been covering the renewable energy industry since 2006.

According to Lacey, First Solar survived the first solar boom with a single-minded devotion to cost reduction. And it was that devotion to cost cutting that helped it survive the cheap solar swoon in 2012.

Canadian Solar is a Canadian company that manufactures panels in China and Ontario where it took advantage of the province's feed-in tariff. The company is very good at identifying and supplying booming solar markets and it is now a key supplier in Japan.

Canadian Solar is a Canadian company that manufactures panels in China and Ontario where it took advantage of the province's feed-in tariff. The company is very good at identifying and supplying booming solar markets and it is now a key supplier in Japan.

And Solar City has Tesla founder and stock market darling Elon Musk behind it. It started out as a large-scale installer and financer of solar systems, but it has recently transitioned into a vertically integrated company by buying up manufacturing, racking and customer acquisition companies.

Global energy markets play in a very complicated policy landscape, but even considering the risks, Lacey says solar has passed the inflection point: “I think we’re starting to get to the point of no return.”

This is good news if you want to see a world with more clean energy. However, investing in solar stocks is not for the faint of heart. Schnell warns these stocks can see 50 per cent swings in both directions and leading companies can change anytime. If you’re comfortable with that kind of volatility, by all means invest, but meanwhile I’m going to enjoy my wine and the oncoming success of solar from an armchair.

-30-

David was the host and producer of the Green Energy Futures multimedia series.

Duncan was the editor and production manager of Green Energy Futures until 2015.